Solana-based institutional investment products ruled the roost during the previous week, attracting a record-breaking amount of inflows

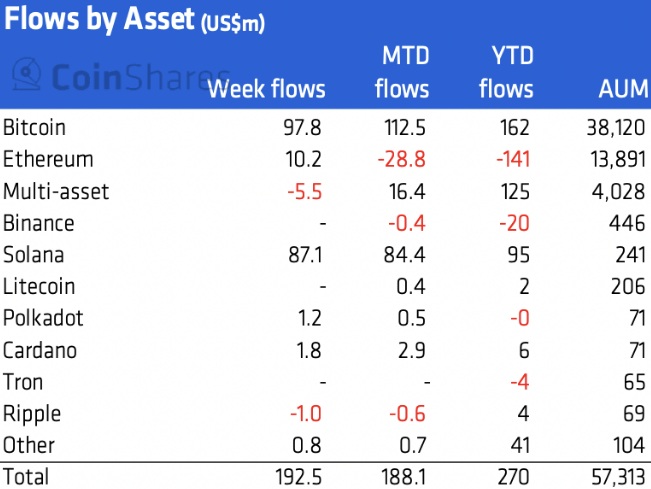

According to data provided by digital asset management firm CoinShares, Solana-based institutional investment products saw a record $87 million in inflows in the previous week.

Solana has now attracted a total of $241 million worth of assets under management, which makes it the fifth-most popular cryptocurrency with institutional investors.

Bitcoin funds saw inflows of $98 million, attracting the largest share of investment capital.

Ethereum-linked investment products come in a distant third place with $10.2 million. Funds tied to Cardano and Polkadot brought in $1.8 million and 1.2 million worth of fresh funds, respectively.

A total of $193 million was injected into all cryptocurrency funds last week, which is the largest amount of money since mid-December. The figure shows that institutional investors are regaining confidence in the crypto market, which has been caught in a bearish trend over the past few months. Last week, for comparison, crypto funds saw $47 million in outflows.

XRP is the only cryptocurrency to record negative inflows over the last week, with investors withdrawing $1 million from funds tied to the controversial Ripple-affiliated cryptocurrency.

Europe takes the lion’s share of admissions (76%). American funds were responsible for the rest of the sum.

The overall amount of crypto under management currently stands at $57 billion, with Grayscale accounting for the vast majority of the sum.

Blockchain-related stocks also followed the general trend, seeing $23 million in inflows over the past week.

The whole cryptocurrency market is now in a recovery mood, with the price of Bitcoin recently reaching a multi-month high of $48,000.

Terra (LUNA) leads the market with a price increase of 7.91% in the last 24 hours.