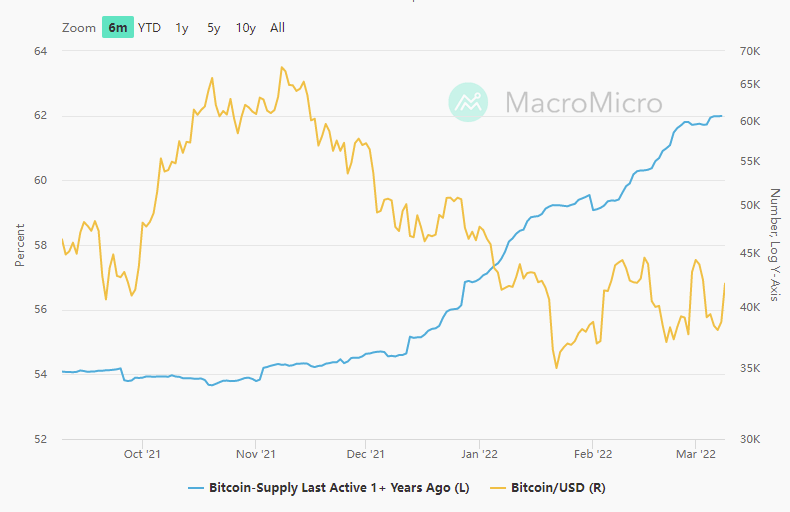

Number of dormant Bitcoin addresses is rising as market progressively recovers

According to MacroMicro’s on-chain data on the number of inactive Bitcoin wallets, the market could soon face a sharp spike in volatility if the funds concentrated in these wallets flow into the market.

Previously, a large satoshi-era wallet was activated by its owner, and 407 BTC could have potentially hit the market right before the spike to $42,000. The large wallet initially purchased the same amount of coins for approximately $355,000, a sum that is now worth more than $17 million.

Why is a large number of inactive addresses dangerous?

First of all, dormant wallets from times when Bitcon was trading significantly lower than today contain a large amount of unrealized coins, and as soon as they hit the market, they can lead to increased volatility and simply create excessive selling pressure on traders.

Usually, dormant addresses become more active at a rally’s top when whales or large wallets take profits.

In other cases, wallets that have been inactive for more than five years may be activated for the sake of redistribution of funds. Blockchain security companies quite often recommend transferring large funds from hot cryptocurrency wallets to cold non-custodial entities.

Previously, a major decrease in the total number of dormant wallets suggested that the market was losing the major part of its holders, which caused progressive fading of the price that tumbled down from $69,000 to $35,000.

At press time, on-chain data suggests that the number of inactive addresses is currently on the rise, showing accumulation or holding patterns appearing in the market.