Over the last 30 days, Bitcoin’s hashrate has been coasting along at the highest levels ever recorded during the network’s lifetime. Bitcoin’s price improved recently but it is still down 38% from the crypto asset’s high, making bitcoin less profitable to mine. However, bitcoin mining is still profitable, in contrast to ten years ago, when the leading crypto asset’s value crashed below the cost of production.

Bitcoin Price Is 38% Below All-Time High, Bitcoin Miners Still Profit

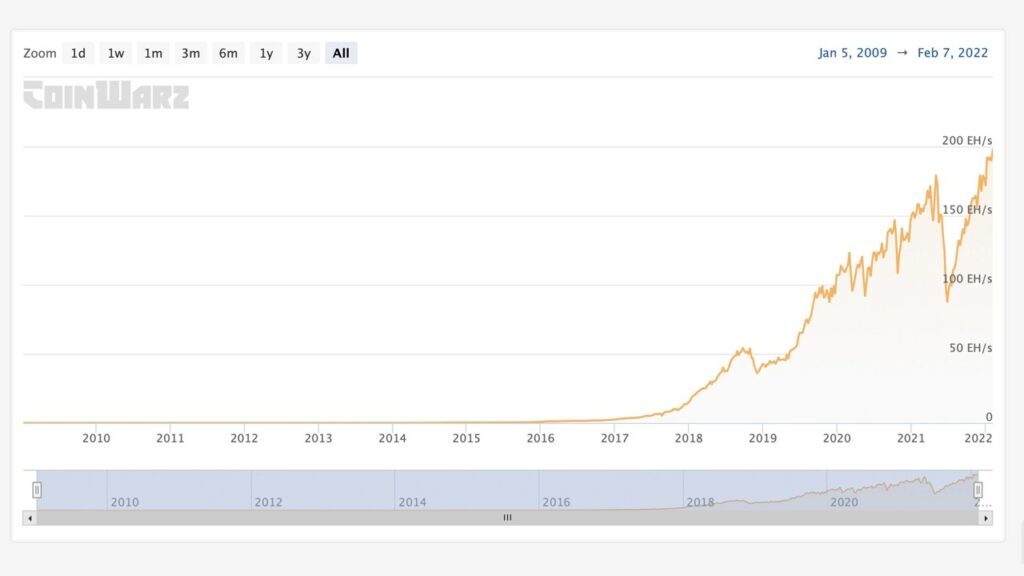

While bitcoin’s price value has climbed quite high against the US dollar over the past 13 years, the network’s hashrate has also reached all-time highs. Today, the hashrate exceeds two hundred quintillion hashes per second (H/s), which is much stronger than the hashrate of the Bitcoin network on January 5, 2009. On that day, statistics show that nine hundred and forty -eight thousand H/s was dedicated to protocol security. Calculations show that Bitcoin’s hashrate has increased by twenty-one quadrillion percent – or 21,093,375,098,215,930% – since January 5, 2009.

Bitcoin’s hashrate is coasting along at all-time highs, but the crypto asset’s value is 38% lower than it was three months ago, on November 10, 2021. This in turn has made it less profitable to mine bitcoin (BTC), but still profitable for a decent majority of high-powered mining rigs. For instance, using today’s BTC exchange rates, the Bitmain Antminer S19 Pro with 110 terahash per second (TH/s) will produce $16.81 per day if the machine’s electrical costs are around $0.12 per kilowatt-hour (kWh). SHA256 machines that produce at least 25 TH/s will still turn a profit using today’s BTC exchange rate and $0.12 per kWh.

Mid-October 2011: Bitcoin price falls below cost of production

More than ten years ago, on October 18, 2011, the cost of a single bitcoin fell below the bitcoin production price (BTC). It wasn’t the only time this happened, but it was one of the first times the price of bitcoin was below the cost of mining the digital currency. That week in 2011, the network hashrate was around 8.596 TH/s or 8,596,000,000,000 hashes per second. While the hashrate was much lower than today, it was still nine hundred and six million percent (906,593,161.72%) higher in 2011 than on January 5, 2009.

At the time, when BTC’s price fell below the cost of production, it made international headlines. The Guardian’s contributor Charles Arthur wrote about the incident on October 18, 2011, when he explained how BTC’s price crashed from a high of over $30 per unit to $1-2 per BTC in mid-October. That year, Arthur called BTC a “‘Hackers’ virtual currency and favoured means of exchange.” The Guardian writer’s report said that BTC’s price “plummeted across exchanges – to a level where it costs more to ‘mine’ them than they are worth.”

Bitcoin’s Value Falls Below Production Cost in 2015, 2018, and 2020 – Estimates Say “Current Production Cost is $34,000”

About a year after the high price of 2013, the value of BTC started to fall again below the cost of production. During the first week of December, the network’s hashrate declined and Spondoolies-Tech CEO Guy Corem explained how the market value of the crypto asset was affecting miners at the time. “Under the current bitcoin value, mining gear efficiency of 0.5-0.7 J/GH and energy cost, we will break even very soon,” Corem said. The cost of mining BTC would have been more than it was worth in mid-January 2015 after Corem made these claims. That month in 2015, the price of bitcoin (BTC) fell below $200.

According to reports in mid-December 2018, BTC’s price was lower than production costs again. At that time in 2018, BTC was changing hands for $3,200 per unit. Furthermore, on March 12, 2020, often referred to as ‘Black Thursday,’ BTC’s price shuddered and tanked down to the mid-$3K range, making it unprofitable for a majority of the network’s mining participants. While BTC’s price is 38% lower than the all-time high, some believe that it is still near current mining costs. In mid-January of this year, the popular Twitter account dubbed ‘Venture Founder’ told his 14,600 social media followers that “current production cost is $34K.”

Venture Founder also mentioned that the value of the crypto asset fell below the cost of production in December 2018 and March 2020. “at risk of miner capitulation”, Venture Founder tweeted. “BTC risked miner capitulation at $30,000 in May. Current production cost is $34,000,” he added.

Can Bitcoin’s All-in Sustaining Production Cost Rise?

Knowing exactly what the cost of production is, and what a bitcoin miner’s all-in sustaining cost is, would be extremely hard to estimate, but there have been many who believe there is a number. The aforementioned instances describing the times and price-points where people believed the price of BTC had fallen below the cost to mine the crypto asset are a perfect example of this belief.

For example, while a miner operates a 100 TH/s machine and gets a daily profit for that machine of around $16.81 per day with electricity costing $0.12 per kWh, another miner might pay $0.06 per kWh. Moreover, a study published in October 2020 claims that “the cost of bitcoin mining has never really increased”.