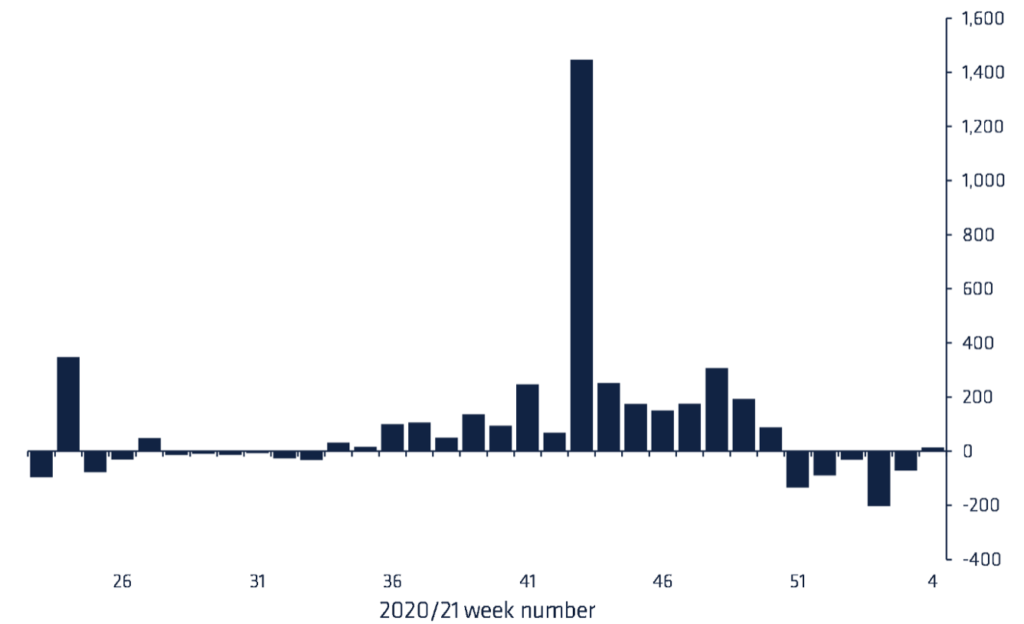

Selling over the past few weeks has been compounded after the crypto market suffered a massive price correction. At the time of writing, the global crypto market capitalization stands at just $1.62 billion. However, digital asset investment products saw inflows last week for the first time this year (2022). A small but significant development.

A ‘buy-the-dip’ underway?

According to the latest CoinShares report, this past week saw a break in the five-week streak of outflows. However, total assets under management (AuM) shrunk to its lowest level since early August 2021 – A free-fall of 41% from its $86 billion peak in November 2021.

Chief executive of digital asset manager Coinshares, James Butterfill, said:

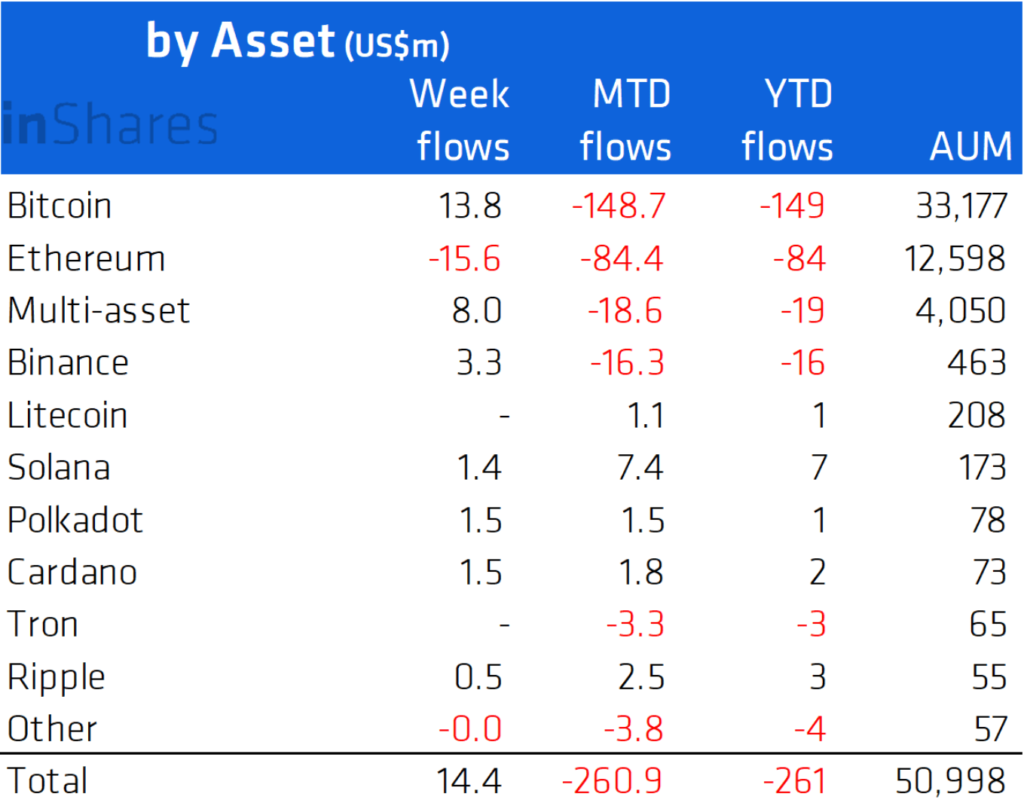

“Digital asset investment products saw inflows totaling $14.4 million last week, breaking the previous 5-week outflow streak. Inflows came later in the week during a period of significant price weakness, suggesting that investors at current price levels see this as a buying opportunity.

As per the report, inflows of $14M suggested investors have been taking advantage of the price dip, thus giving support to the “buy the dip” narrative.

However, that’s not all. In fact, different cryptocurrencies have a different set of bulletins.

Bitcoin

The king coin finally found some good news coming its way. Bitcoin enjoyed inflows last week of $14 million after losing nearly $320 million in outflows over the last five weeks. This represented 1% of AuM over the 5 weeks prior.

The attached table can be used to highlight the aforementioned statistics.

Needless to say, altcoins had a slightly different experience.

Ethereum facing problems

Indeed, this was the case with Ethereum, the largest altcoin on the market. Digital asset investment products based on the second-largest cryptocurrency continued to see outflows. According to the findings of the report,

“Ethereum continues to see outflows, with US$16m of outflows last week. The current 7 week run of outflows now total US$245m, or 2% of AuM, highlighting much of the recent bearishness amongst investors has been focused on Ethereum rather than Bitcoin.”

Meanwhile, among altcoins, Cardano, Polkadot, and “investor favorite” Solana saw inflows of $1.5 million, $1.5 million, and $1.4 million, respectively.