In an undecided spot market, low order book liquidity allows aggressive traders to take control, leading to unexpected volatility. Currently, the futures market may see more liquidations before any recovery in price.

Technical Analysis

Daily Timeframe

The image below shows that bitcoin is in a strong downtrend, and the bears are in charge. However, we’re in a zone that can hold the price for a few days or even weeks. Additionally, the RSI indicator, which helps us gauge the price momentum (currently <20), shows that the market is in a “Strong Oversold” phase.

4 hour delay

On the 4-hour time frame, we can observe that the price formed a continuation pattern followed by another bearish impulse after the bearish flag breakout.

It’s also clear that RSI is probably creating a bullish divergence, indicating that the price is likely to consolidate in the short term. It’s important to monitor the market in the next few days to determine if the price has formed an accumulation/distribution pattern to forecast future action.

Onchain Analysis

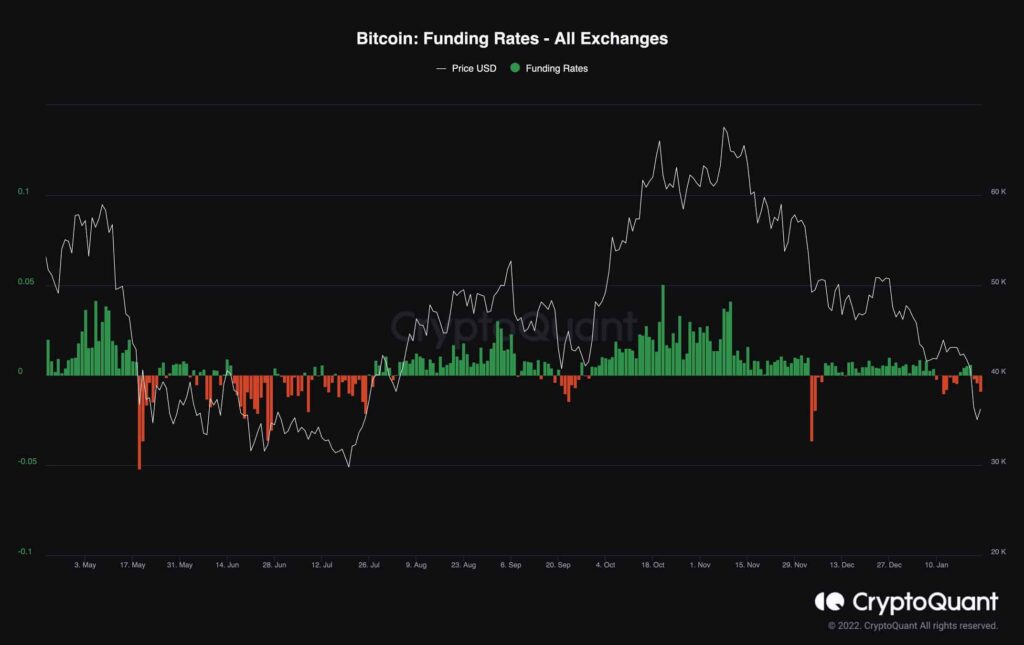

Retail traders tend to enter high-leverage positions in futures markets. This behavior indicates a market with an excessive appetite for risk and leverage. Naturally, when the bitcoin price is falling, the high-risk positions vulnerable to volatility will cause a cascade of liquidations.

Following futures market sentiment in June-July 2021, a significant decline in open interest (OI) is crucial before any price recovery.

A sharp decline in both OI and ELR metrics, as well as a long period of negative funding rate, are the necessary signals for a market recovery.