If one is to believe the Fear and Greed Index, then today marked the biggest fear in the cryptocurrency market since July 2021. The popular sentiment indicator points to an extreme fear of 15 today.

The reason for this extreme sentiment is the drop in the price of Bitcoin yesterday to nearly $ 43,000 and the break of the 32 day support line. This led to the liquidation of cryptocurrency futures contracts, most of which were long positions. As a popular cryptocurrency analyst @intocryptovers tweeted, “$ 725 million in #crypto liquidations [have taken place] in the last 24 hours.

In the BTC futures market alone, liquidations totalled $318 million. Of these, as many as 88% were long positions. The most likely reason for the deepened decline was the cascading liquidation of long positions after BTC lost support near $45,500. Since that event, Bitcoin has bottomed at $42,500 in just four hours.

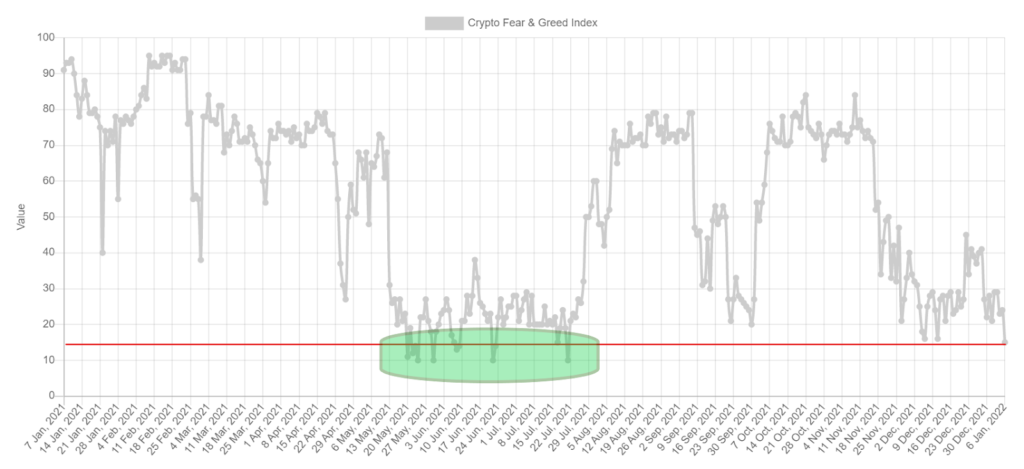

Fear and greed index at its lowest since July 2021

The worsening decline and liquidation of long futures was instantly correlated with readings of the popular Fear & Greed Index. Its value today is only 15 on a scale of 0 to 100. Additionally, all basic readings of historical values indicate extreme fear today.

This is the lowest value since the end of July 2021, when Bitcoin experienced a deep correction after the historic all-time high at $64,850. At that time, the index fell below the 15 level (red line) several times and was near extreme fear for about 3 months (green area).

However, it should be mentioned that at the time the price of Bitcoin was trying to maintain support around $ 29,000. Today we are seeing a market filled with similar sentiments, but BTC is trading around $ 43,000.

It is common knowledge that the Fear & Greed Index is both a pretty good indicator of market participants’ sentiment and an indicator of investment opportunities. If interpreted inversely, its readings can be a cue for the best buying and selling opportunities in the cryptocurrency market.

This relationship was exemplified by cryptocurrency analyst and content creator @Kellykellam who tweeted a modified version of the Fear & Greed Index. According to her interpretation, current readings indicate “extreme buy” levels. Interestingly, the index itself was renamed “Smart Money Index” in its version.