It’s not news that a growing number of private investors are looking to gain more exposure to cryptocurrencies, as the asset class has grown from its nascent state into a popular financial instrument.

VC Investments Surge 450%

With corporate investors seeing the opportunities associated with cryptocurrencies, a recent report published in CryptoQuant suggests that such businesses saw an inflow of more venture capital (VC) funding in 2021 compared to previous years.

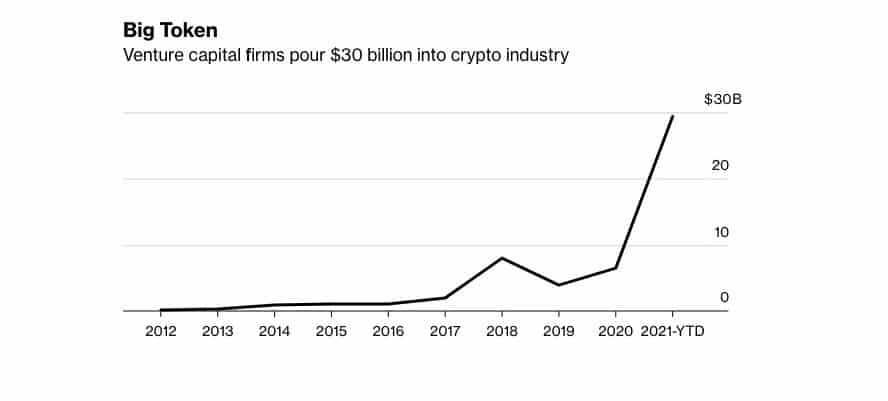

In 2020, crypto companies registered a handful of venture capital investments, amounting to just $ 5.5 billion. However, the figure jumped 450% in 2021, when around $ 30 billion was poured into the sector by venture capitalists.

Per the report, the $30 billion investments from VCs last year smashed the all-time highs (ATHs) recorded in all previous years since the inception of the asset class.

Bitcoin ETF Approval Promotes VC Investments

CryptoQuant noted that the majority of the funding came in October after the U.S. Securities and Exchange Commission (SEC) approved the first bitcoin exchange-traded fund (ETF).

Last year, several crypto-related companies raised over $100 million from VCs, including the developers of the Axie Infinity blockchain game, Sky Mavis.

NYDIG tops the list of crypto companies that have raised substantial sums from VCs, with its $ 1 billion fundraiser led by Westcap in December. This increased the valuation of the company to $ 7 billion.

In November last year, popular cryptocurrency lending platform Celsius Network increased its $400 million Series B funding round recorded in October to $750 million after the event was oversubscribed.

a16z launches $ 2.2 billion crypto fund

While investment firm WestCap has led the NYDIG and Celsius Network funding rounds, the role played by other VC firms in cryptocurrency investments over the past year has also been significant.

American venture capitalist Andreessen Horowitz participated in different funding rounds ranging from cryptocurrencies to Web3 sectors. This became possible after announcing the launch of a $2.2 billion fund exclusively focused on digital assets.

Coinbase Ventures, Binance Labs, and Galaxy Digital Holdings, among others, have also joined several crypto-related investment rounds.

A majority of the funding was used to enhance the operations of cryptocurrency companies in terms of employee recruitment, the launch of new products and services, and obtaining the necessary regulatory approval.