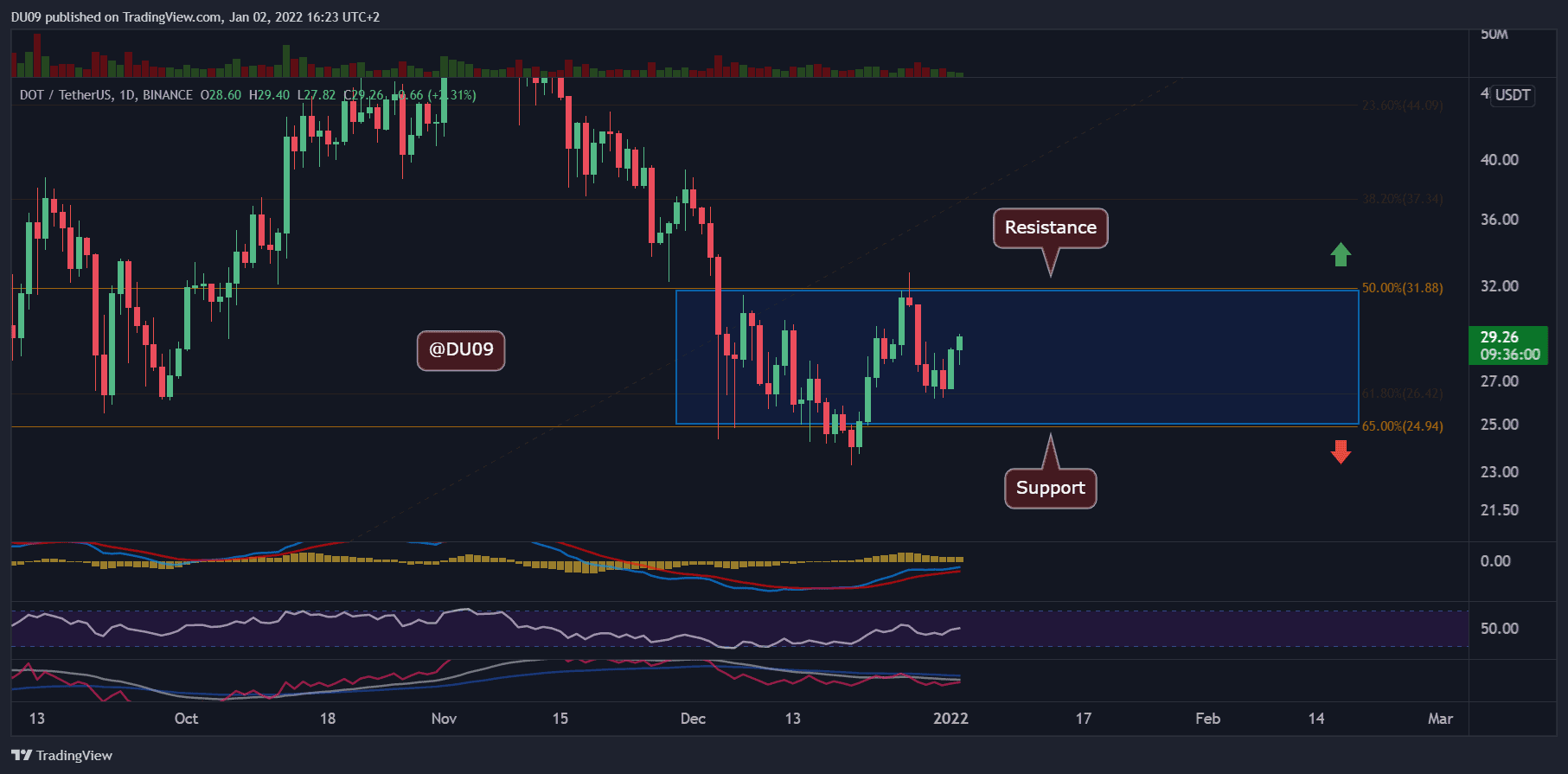

After an 8% daily increase, DOT attempts to retest key resistance at $ 32 on new momentum.

Key assistance level: $ 25

Key Resistance Level: $ 32

Polkadot’s DOT native token completed a short-term correction and is now creating a support floor and trading range between the support level at $25 and resistance at $32.

The first attempt to break through over this trading area was rejected last Monday. However, DOT appears ready for a second try.

Technical Indicators

Trading Volume: A reasonable amount of volume on the last attempt on Monday to break above $32. The current volume is a bit low (maybe due to the weekend), but it favors the buyers right now. Watch out for the volume on Monday.

RSI: RSI is hitting higher lows, which is a bullish sign, and currently sits just above 50 points – the neutral level.

MACD: The daily MACD is bullish and is heading up, despite the rejection at key resistance last Tuesday. This is a promising sign for bulls.

Bias

The bias on the DOT is somewhat bullish, but a breakout of the critical resistance is needed to confirm this.

Short-Term Prediction for DOT Price

DOT managed to stop the downtrend and consolidate under the key resistance at $32. Now, buyers appear eager to take DOT back up again as they prepare the stage to break the key resistance. Should they fail, DOT will face the ‘floor’ level at $25. Watch out for possible volatility to return next week following the new year holiday.