Since the mid-year massive sell-off, bitcoin miners’ reserves have steadily increased and their total holdings have peaked in six months.

Additionally, on-chain data showed that the reaccumulation levels had reached the September highs, right before BTC started to gain value rapidly.

Minors returning to HODLing

It was in June of this year that most bitcoin miners got rid of a significant portion of their holdings over a relatively short period of time. This had a catastrophic effect on the price of the cryptocurrency, which had already retraced from the April ATH, but kept plunging and falling below $ 30,000.

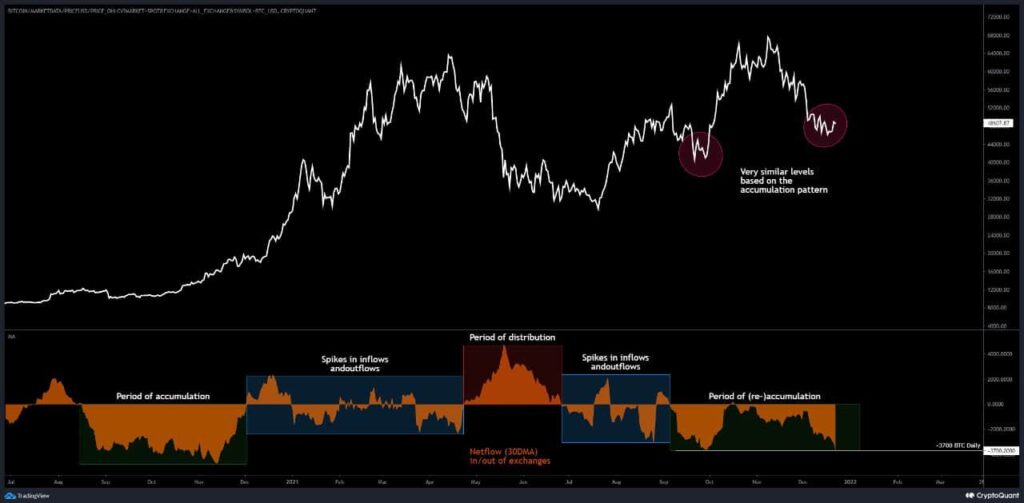

Since then, though, miners changed their stance and started to HODL more, as CryptoQuant’s chart below shows. Following a few more months of keeping relatively steady holdings, their positions started to increase in early December. Consequently, miners’ inventory balance has now tapped a new six-month high.

The analyst firm claimed it was still “very bullish,” which is supported by the fact that miners are now holding more BTC compared to when the asset peaked at $ 69,000 in November.

“Aside from some light net distribution from time to time, this accumulation trend never changed.” – said CryptoQuant’s analyst.

Another bullish signal provided by the company shows that large entities have started to withdraw substantial amounts of BTC from centralized exchanges. The current landscape is “very similar” to September, when bitcoin rose 70% in a matter of weeks.

The Great 2021 Miners’ Migration

Aside from their BTC holdings, miners went through a rollercoaster of a year in 2021. It all started quite positively as bitcoin’s price was appreciating in the first few months. However, the situation changed vigorously once China reiterated its ban on anything crypto and went after miners.

The world’s most populous nation, responsible for over 60% of the BTC hash rate at that time, pushed them all back. Therefore, they shut down their machines while looking for a new place to settle. This was around the time the June massive sale took place.

As miners were finding new homes, mainly in the Western hemisphere, the hash rate started to recover after the massive mid-year dump.

Recent reports suggest that China is now responsible for nearly zero percent of the hash rate, while the United States has taken the lead, followed by the Russian Federation and Kazakhstan.