Since the NFT sector is known for both famous collections and individual works by artists, it’s easy to view the market in fragments. However, Chainalysis’ 2021 NFT Market Report sheds light on broader trading trends and investor behavior.

It’s time to ‘Gogh’ into the facts

Pundits and analysts love to describe the NFT “summer” or the NFT “boom” of 2021. But, when exactly did that happen? The Chainalysis report pointed to a “notable spike” from the last week of August after the Bored Ape Yacht Club released a new collection.

Coming to marketplaces, OpenSea was a clear winner after it fished in more than $16 billion in crypto, just this year alone. Meanwhile, Ethereum smart contracts ERC-721 and ERC-1155 bagged $26.9 billion in crypto.

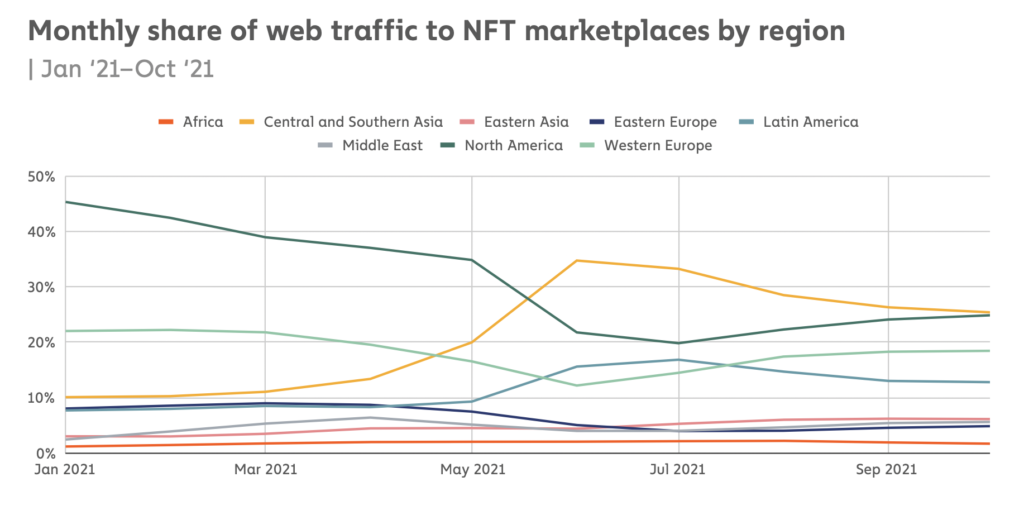

When examining NFT buyers around the world, readers might be surprised to learn that there is no obvious winner. While North America and Central and South Asia saw significant web traffic rates to NFT markets, other regions also saw numbers rise and fall in 2021.

The report stated,

“The numbers suggest that like conventional cryptocurrency, NFTs have achieved global popularity, with no region making up more than 40% of monthly web visits since March 2021.”

“Brush” on your strategies

So, readers might ask: What does a successful NFT trader look like? According to the Chainalysis report, these are likely creators whitelisting users – or adding investors to a special list so they can purchase NFT products at a discount. In addition, it can be very lucrative. Chainalysis observed,

“OpenSea data shows that users who make the whitelist and later sell their newly-minted NFT gain a profit 75.7% of the time, versus just 20.8% for users who do so without being whitelisted.”

Another strategy is NFT flipping, which affects both NFT series and addresses doing the flipping. Here, there is a striking collection of actors who dominate the NFT Resale. The report noted,

“20% of user addresses on OpenSea account for 80% of secondary NFT sales, while just 5% of all addresses account for 80% of profits made on secondary sales.”

Other factors that helped influence profits were the trading experience and the allocation of capital among the NFT collections. Additionally, most successful NFT traders seem to prefer DeFi platforms.

A lot of ‘Monet’ needed

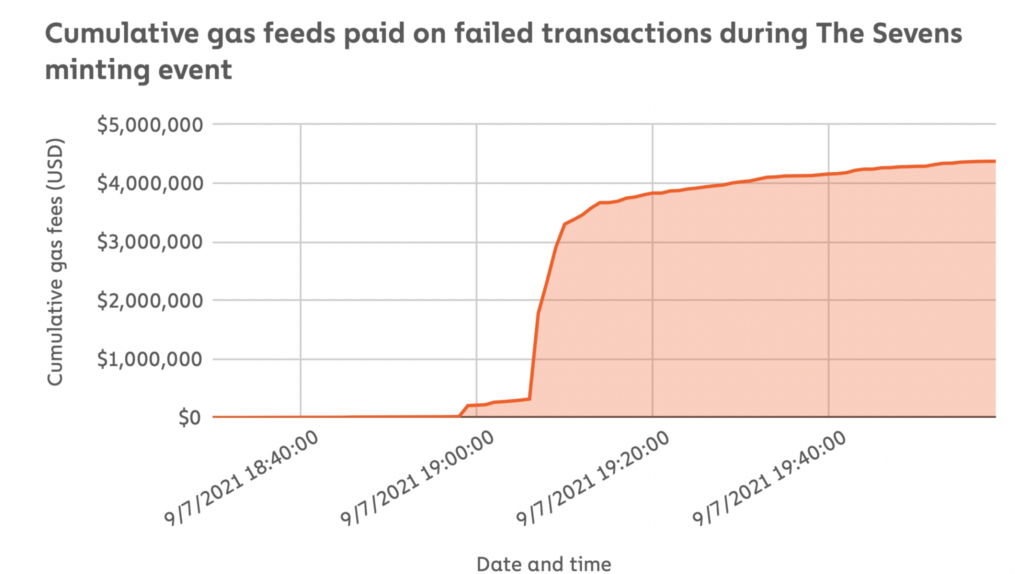

All said and done, NFTs are far from art therapy while gas fees and failed transaction fees continue to challenge users. These glitches can result in serious profit losses or even millions of dollars in fees.

To address this situation, the report proposed hitting NFTs on Layer 2 platforms before allowing users to move purchased assets to the blockchain.