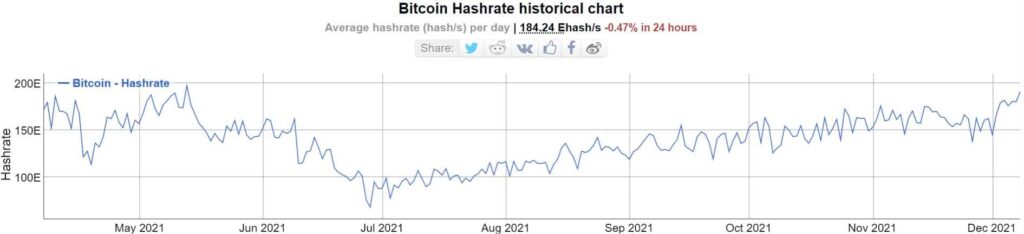

It took bitcoin’s hash rate less than six months to recover from its China-induced crash. The metric, showing the robustness of the world’s largest blockchain, has increased by about threefold since the end of June and is close to the ATH operated in May.

BTC’s Hash Rate Nears ATH Six Months Later

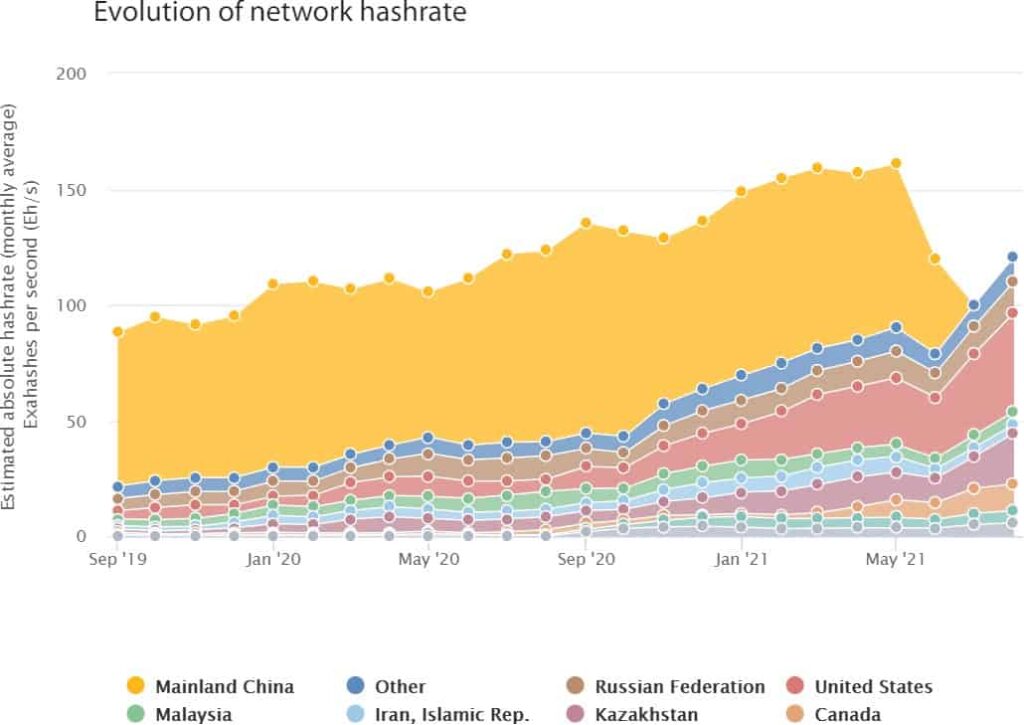

The hash rate reached an all-time high in May this year at nearly 200 Ehash/s, according to data from BitInfoCharts, when the situation changed vigorously. China, the world’s most dominant country in terms of BTC mining responsible for over 60% of the overall hash rate at the time, reiterated its ban on everything crypto and went after miners.

As they shut down their machines and started looking for new homes, the metric dropped. It went down by about 65% in a few weeks. The peak came in late June when the hash rate fell to 68 Ehash / s.

This caused significant damages to the network as the block rewards were delayed until the blockchain went through the much-needed negative readjustments. In fact, it underwent the longest streak of negative mining adjustments at that point.

However, as the miners started to settle in other areas and the difficulty adjustment played its part, the hash rate started to pick up. So it doubled at the end of August and has now almost tripled to 184.24 Ehash / s. Specifically, the metric has risen 170% since the low in late June.

Moreover, the mining difficulty also went through nine consecutive positive adjustments, showing that more and more miners are getting onboard.

The United States takes over

As China hunted miners, the network needed a savior. With many prominent Americans, including politicians, urging the country to adopt them, many miners have apparently moved to the United States.

Data from Cambridge shows that the world’s most powerful economy has become the clear leader in terms of BTC hash rate share. As of now, the nation is responsible for nearly 43% of the total bitcoin hash rate, leaving Kazakhstan (21.9%) and the Russian Federation (13.6%) far behind.