On December 4, bitcoin suffered its worst trading day since mid-May, as its price plunged to a two-month low of $42,000. Somewhat expectedly, this massive $16,000 crash in less than 24 hours led to a change in investors’ sentiment as the popular Bitcoin Fear & Greed Index went into “extreme fear” territory once again.

Extreme fear shakes the crypto community

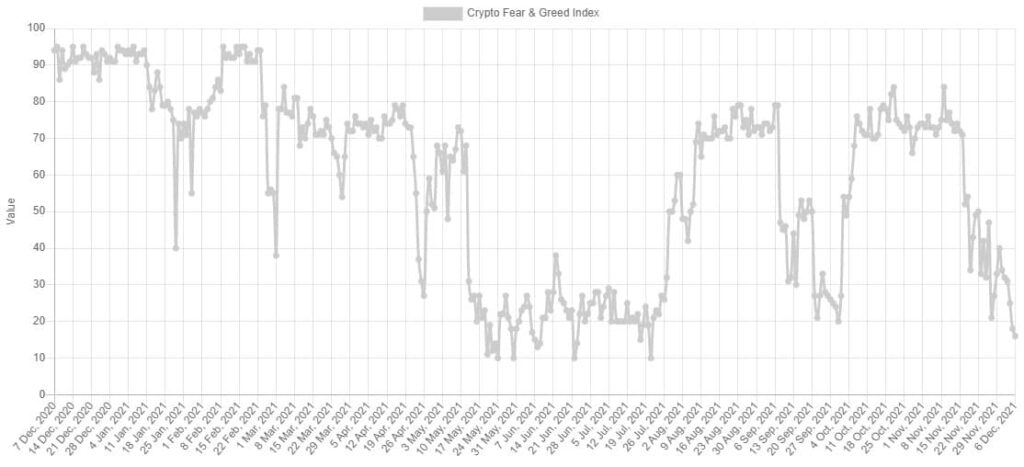

The Bitcoin Fear & Greed Index works as an indicator of the momentary feelings of investors towards the main cryptocurrency. It tracks multiple segments such as asset volatility, volume, social media comments, polls and more to provide a score between 0 (extreme fear) and 100 (extreme greed).

Following the recent bloodbath in the cryptocurrency industry, and more specifically, bitcoin’s price dump to around $42,000, the metric now points at 16 – “Extreme Fear.” It is worth noting that the last time the index showed a number lower than 16 was July 21. Back then, BTC’s USD value dived under $30,000.

In the following days, the BTC bulls attempted to push the price towards $ 60,000 but with little success. As might be expected, the Bitcoin Fear & Greed Index moved to “Fear” and “Extreme Fear,” indicating the concerns of cryptocurrency investors.

In the following days, BTC bulls tried to push the price towards $60,000 but without much success. Somewhat expectedly, Bitcoin Fear & Greed Index went to “Fear” and “Extreme Fear,” indicating the concerns among cryptocurrency investors.

According to analysis firm CryptoQuant, the on-chain developments before the crash could have predicted what happened. One of the signals was the number of bitcoins sitting on the exchanges, which rose sharply hours before the crash.

Whales to Sell More?

CryptoQuant’s Exchange Whale Ratio, which compares the top 10 largest deposits to exchanges with all other deposits, large BTC holders have been increasingly depositing more substantial quantities of the asset to trading platforms lately.

The metric typically sits above 85 only in bear markets. However, it has topped 95 in the last few days after a sudden rise before the crash. Therefore, the analytics company warned that the price of BTC could soon face another drop if the whales decide to sell in large quantities.

Is It ‘Buy The Dip’ Time?

While “Extreme Fear” might not sound like a ringing bell for individuals to enter the crypto market, many experts actually believe that bitcoin being in that state is a good buying opportunity. It is worth mentioning that the billionaire investor – Warren Buffett – once said investors should be greedy when the crowd is fearful and vice versa.

At first glance, the authorities in El Salvador (the Latin American country where bitcoin is legal tender) are favorable to the fall in prices and support Buffett’s thesis. A few days ago, President Nayib Bukele announced that the country had purchased an additional 150 coins at an average price of just over $ 48,500.