The anticipation of a lunar November has faded over the past week. Consider this – the price of Bitcoin has maintained its fork-linked momentum and Ethereum has appeared to follow the movement of the royal coin. Bitcoin, at press time, was trading close to $56k while Ethereum slipped under the $4300-mark.

Besides the waning euphoria, short-term market pressure may also increase due to changing macroeconomic conditions. Notably, U.S. bond yields have been rising sharply over the past few weeks. In fact, the yield on the two-year note fell from 0.24% in September to almost 0.60%. Oddly enough, expectations around a possible rise in interest rates have also increased.

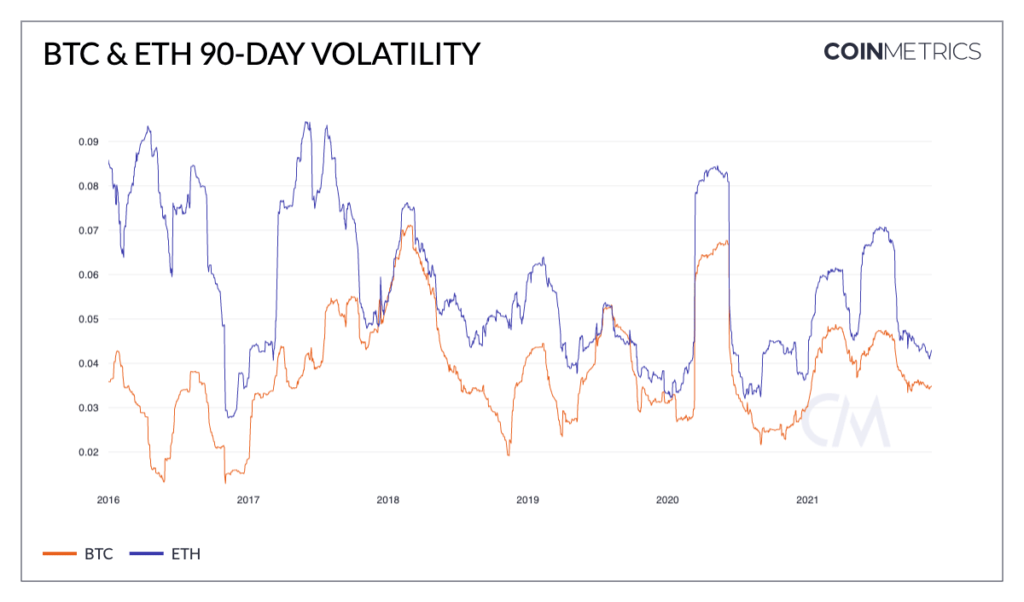

Not to forget, digital assets, especially crypto, are generally perceived as riskier assets. A higher ‘risk-free’ rate of return could also reshuffle capital in financial markets, as pointed out Data from CoinMetrics. While most of the market has been riding a wave of volatility, it seems like relative volatility hasn’t really taken over in this case yet.

Volatility is still not high?

The markets looked rather turbulent with volatile prices and unexpected drops. Even then, volatility has still been relatively low for both Bitcoin and Ethereum on a historical basis. And, far from the highs measured earlier this year. The same could also be seen using the daily log returns on a 90 day sliding window.

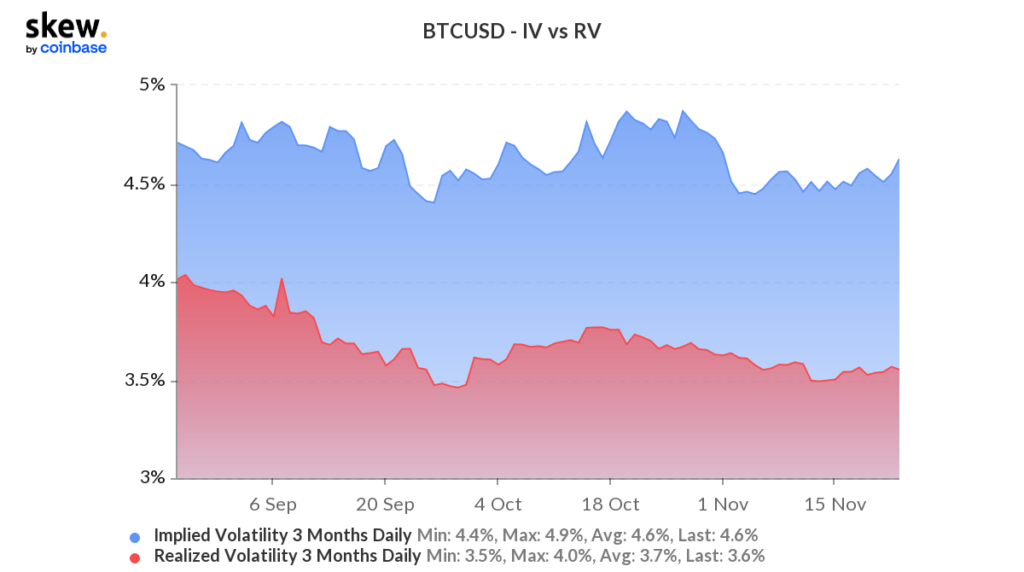

After a lower weekly close, BTC and ETH hit their lower support levels. BTC fell under $55k while ETH went as low as $3980 a few days ago. Notably, BTC’s implied volatility, which presents the market’s forecast of a likely move, had increased and signaled higher expected volatility.

However, its realized volatility continues to maintain more or less the same levels.

This is how it could be …

Looking at supply and demand, many stablecoins sit on exchanges against BTC balances. In addition, the institutional demand for ETF products has also increased.

On the contrary, 200k of $ETH had been deposited on central exchanges, presenting a short-term bearish narrative. Even so, outflows still dominated both the top coins’ markets.

Additionally, Bitcoin’s balance percentage on exchanges reached 12.4% this month. After almost three and a half years, the metric fell back to this level. In fact, this all-time low level was last seen in February 2018.

However, the latest drop in this metric appears to be a macro bullish trend, which appeared to spark the first coin.

Open interest for BTC and ETH has been steadily increasing though, hitting fresh highs last week. In fact, with the futures market looking over-leveraged as people shorted BTC, the market became more sensitive to small price movements. This could amplify short-term volatility.

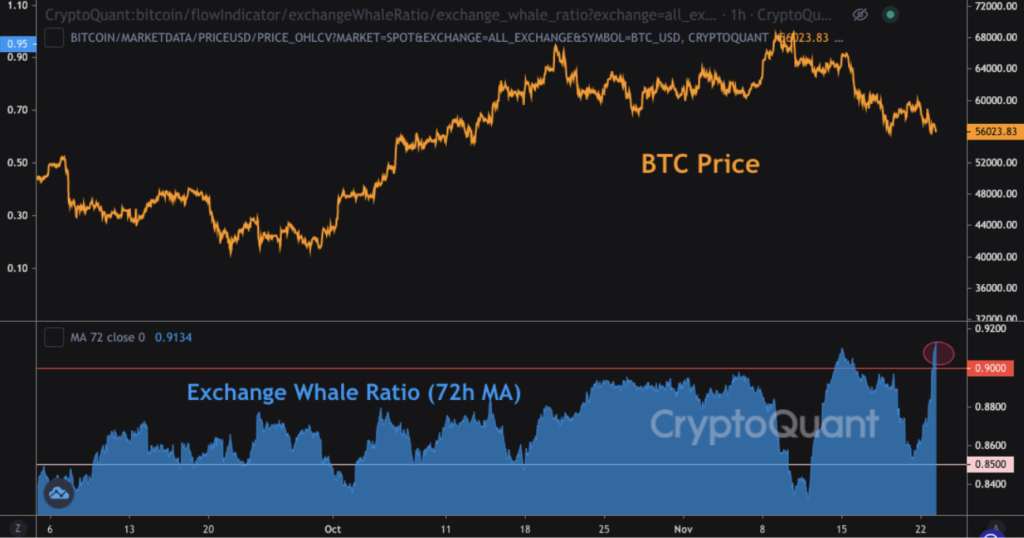

Even so, the Bitcoin Exchange Whale Ratio (72h MA) hit 91% – An indication that the top ten deposits took 91% of the deposit volume across all exchanges on the hourly timeframe. Keep in mind that whale beds are generally not a good sign for medium to short term price action.

For Bitcoin, certain metrics seem to be logging weak bullish indicators. This can mark the early stages of bull runs with sustained accumulation.

However, with price action looking uncertain alongside some bearish signals, nothing can be said for sure at this point.