After the fall in prices on November 16, the price trajectories of flagship assets confused the market, and certainly not in a pleasant way. Bitcoin dropped by almost 13% while Ethereum saw an over 15% price fall as bearish sentiment took over the market.

Nonetheless, over the past couple of days there appears to be some sort of price rally as the BTC daily chart has finally noted green candlesticks. While Ethereum was back above the $4300 mark, BTC still oscillated under the crucial $60K mark. Over the past 24 hours, BTC noted gains of 0.8% while ETH was up 1.16%.

Seemingly, Ethereum’s better price gains over the last couple of days pushed the narrative that Ethereum could probably outperform Bitcoin in the coming weeks. However, could it really go as planned?

Ethereum could take the lead

Even amid the price chaos, significantly more coins left exchanges than entered (close to $3 billion between BTC and ETH alone). This means investors weren’t panicking despite the drop. While Bitcoin’s network revenue fell 22% to a six-week low, Ethereum’s weekly fees remained high around $ 450 million.

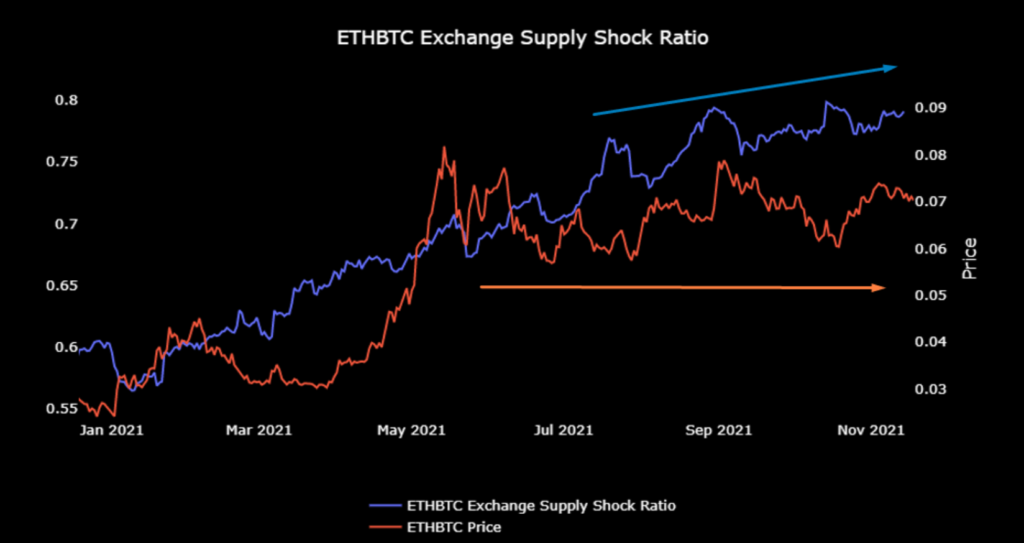

With Bitcoin’s performance relatively weakening, the market’s eyes might be turning to ETH for a quicker recovery. The Exchange Supply Shock Ratio (ESSR), which gives an insight into the underlying demand and supply of the asset, presents a similar bullish picture for Ethereum in the near future.

Notably, the ratio is reaching new highs, while the ETH / BTC price fluctuates, generally, when a similar trend is observed, the price follows the direction of the ratio.

In addition, the price of Ethereum as a percentage of the price of Bitcoin has also seen a slight increase. This is usually indicative of ETH’s price taking over in terms of gains. Thus, seems like there could be a possibility of ETH outperforming BTC in the near term but there’s more to it.

Correlation still intact

Ethereum and the wider market have not been independent of the price dynamics of the Royal Coin. Even though ETH’s trajectory was on an uphill ride all through the last month, BTC and the larger market’s losses engulfed ETH’s rally.

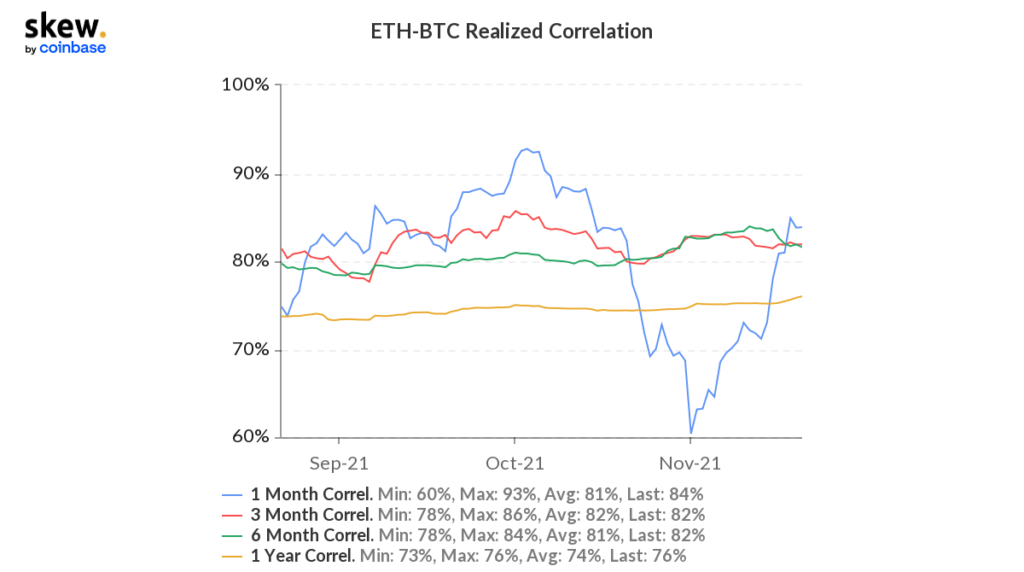

Moreover, the correlation made between ETH-BTC shows that ETH has not really decoupled from the centerpiece. ETH-BTC one-month realized correlation showed how the correlation between the two has spiked since 1 November.

For the first week of November, assets posted higher gains and recorded new ATHs on November 10. However, as the correlation rose, the asset’s dependence was more closely seen. The correlation rose to the highest that is 85% on 18 November as the assets dropped in price.

So while with current gains, Ethereum’s better short-term performance cannot be denied, it looks like reliance on the top coin could still be a spoiler in the future.