Crypto markets recover from painful decline, sentiment indicators are back in neutral

The Bitcoin Fear & Greed Index, an indicator utilized to display whether social media users are, on the whole, optimistic or pessimistic about the short-term dynamics of the crypto king, shows signs of recovering.

Fear and greed index recovers from seven-week low

According to data shared by the Alternative.me web portal, the Bitcoin “Fear & Greed” index has started to recover after losing 50% in three days.

While it is still in the sub-50 zone that refers to “Fear” territory, it inches closer to “Neutral” and now sits at 43/100.

Yesterday, on Nov. 19, 2021, the index bottomed out at 34/100, its lowest level registered since early October. As such, it managed to avoid plummeting to the “Extreme Fear” zone.

Just ten days ago, on November 9, 2021, the index revisited its eight-month high to 84/100. This upsurge is associated with Bitcoin’s rally at an all-time high.

On Nov. 10, 2021, the flagship cryptocurrency spiked over $69,000 for the first time in its entire history on the news of the record-breaking inflation jump in the U.S.

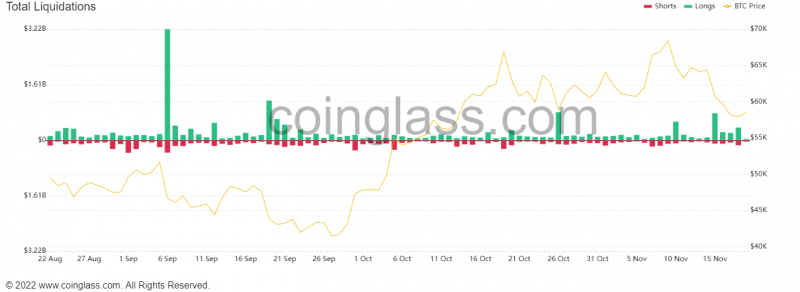

$ 1.1 billion in shorts and longs liquidated in three days

However, this magnificent run has been replaced by a painful correction. Bitcoin (BTC) wiped out all of its gains since mid-October in a matter of hours, plunging to $ 56,500.

These rollercoasters resulted in massive liquidations for all major crypto trading pairs.

According to data shared by the Coinglass (formerly Bybt) analytical dashboard, crypto traders lost over $ 1.12 billion between November 16 and November 18.

The vast majority of positions liquidated were opened by Bitcoin and Ethereum bulls.