Exchange Traded Products (ETPs) are the next big thing for many institutional cryptocurrency investors. In fact, crypto-ETFs have captured a huge share of the market within no time. In one such case, crypto-backed ETFs in America and Australia broke several records within days of trading.

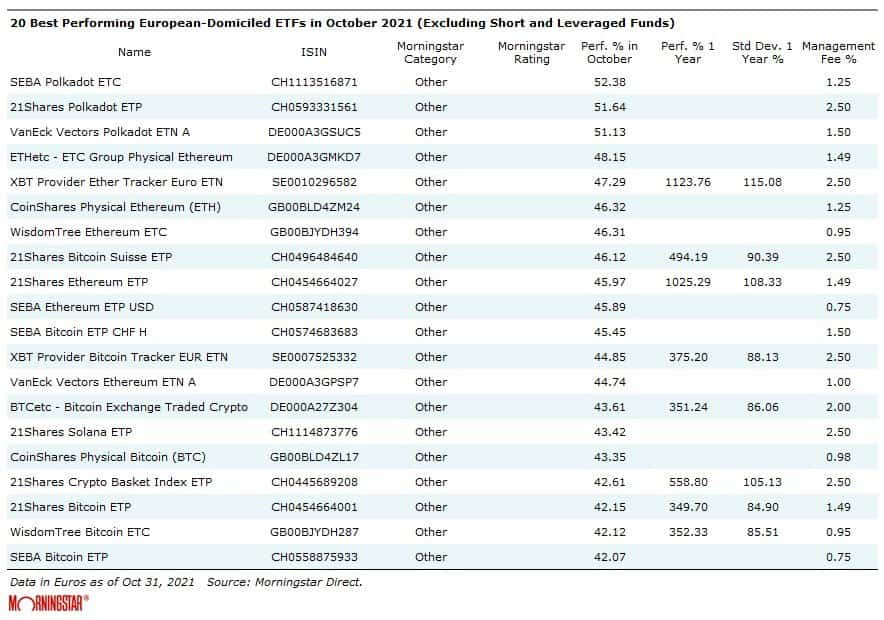

Surprisingly, throughout October, the top 20 performing ETFs in the European market were those backed by cryptocurrencies. Natural gas and Brazilian exchange-traded funds (ETFs) were at the bottom of the list, compiled by Morning Star.

Interestingly, the top eight ETFs were backed by tokens from L-1 protocols like Polkadot and Ethereum. At the top was SEBA Polkadot ETC (SDOT), which was issued by SEBA Bank and began trading on the SIX Swiss Exchange in July, with 52.8% appreciation.

It was followed by ETFs Polkadot de VanEck and 21Shares, which brought DOT to center stage by occupying the top three positions.

Notably, Ethereum ETFs followed those backed by Polkadot. However, Bitcoin ETFs have fallen behind.

Much to everyone’s surprise, the top-ranking non-crypto ETF was positioned 34th, indicating a rising appetite for institutionalized cryptocurrency investment products.

Several European countries have detected the market opportunity by entering the crypto-ETF space early. The U.S. has been quite slow in greenlighting one of its own, with the first few Bitcoin Futures-backed ETFs launching just last month.

That being said, many enthusiasts across the country are now rallying for an ETF backed by Ethereum. The lack of approval for BTC spot ETFs in the United States indicates that Ethereum-backed ones remain much further away, and Polkadot ETFs even further away. Either way looks like it will be Europe taking the lead on this front.