Aave Finance (AAVE), one of the largest DeFi protocols, witnesses the most impressive capital flight in its history

Journalist and insider Colin Wu, an expert in the Chinese cryptocurrencies market, explains why Tron founder and BitTorrent CEO Justin Sun decided to move billions of dollars from Aave’s liquidity mechanisms.

Justin Sun Withdrawn $ 4.2 Billion From Aave: Details

According to Mr. Wu’s statement, Mr. Sun withdrew a 10-figure sum from various digital assets from Aave’s loan pools. Namely, the Tron founder withdrew $2.1 billion in Ethers (ETH), $1.2 billion in USD Coins (USDC), as well as his WBTC, USDT and TUSD bags.

According to the journalist, this garish withdrawal could be the result of concerns about the potential vulnerability of Aave Finance’s design.

Allegedly, this vulnerability is similar to the design flaw of Cream Finance (CREAM) that resulted in a $130 million hack that took place three days ago.

Renowned DeFi developer, main maintainer of Yearn.Finance Banteg has pointed out that Aave’s vulnerability is the same, so it should be made public.

Aave Finance TVL down 28.3% overnight

To protect the stability of the protocol, the Aave Finance community published a proposal to disable borrowing options for XSUSHI and DPI tokens, as well as for UNI/BAL liquidity pools.

This proposal was adopted and will be implemented on November 1, 2021.

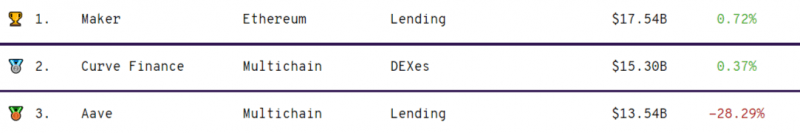

According to third-party analytical dashboards, the total value locked (TVL) metrics of Aave Finance (AAVE) lost 28.3% in the last 24 hours.

Aave remains the third largest DeFi by TVL, surpassed only by Maker and Curve Finance.