Bitcoin is becoming even more popular for institutional investors, with ETFs bringing additional $1.47 billion to the market

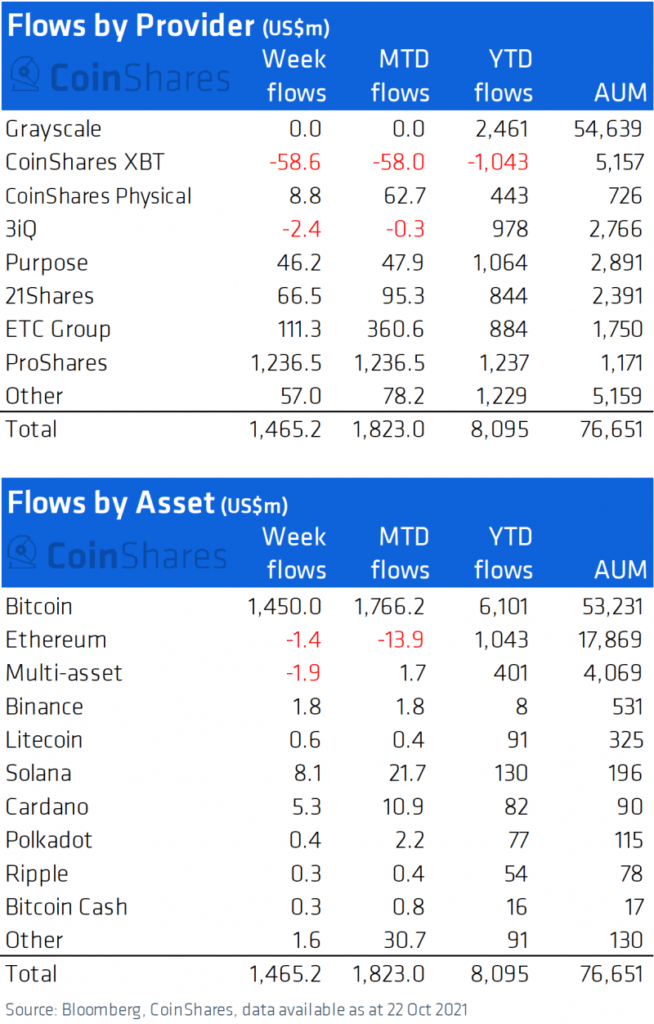

According to the Weekly CoinShares blog “Digital Asset Fund Flows Weekly”, the cryptocurrency industry this week faced a record investment flow of $ 1.47 billion, of which $ 1.2 billion came exclusively from ProShares .

Bitcoin inflows

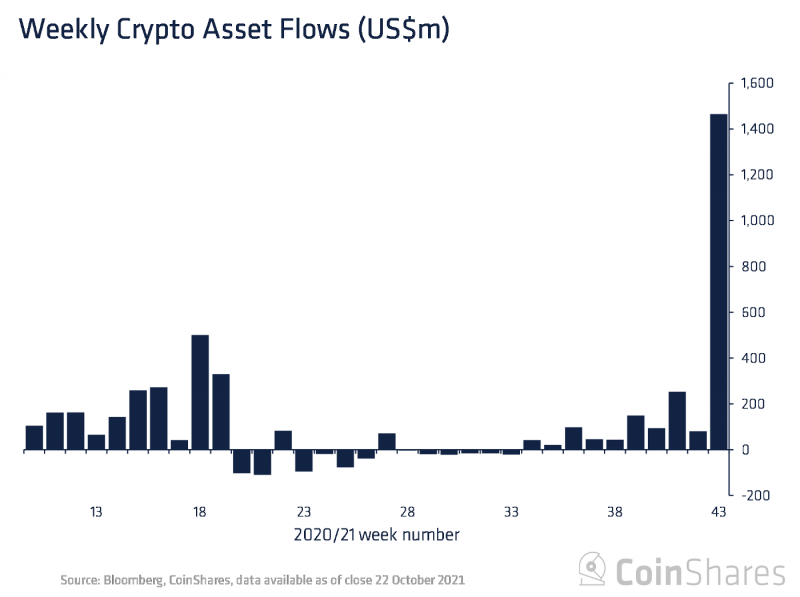

In the previous week, digital asset investment products have faced a total of $1.46 billion inflows, which is currently holding an absolute record with a significant lead in comparison to previous weeks in the year. The total amount of assets under management reached $ 76.7 billion.

It is obvious that massive market inflows are tied to the listing and approval of the Bitcoin futures ETF that brings the majority of this week’s inflows, with ProShares bringing $1.2 billion to the crypto market.

The second largest fund provider from the previous week was the ETC Group, bringing $ 111 million to the market. Only two providers reported the fund’s outflows: CoinShares XBT and 3iQ faced $60 million outflows in total. Cash outflows are most likely justified by a redistribution of funds due to the fact that ETF products are more convenient for investors.

Altcoin market

With Bitcoin becoming more and more popular among institutional investors, some altcoins are going through outflows. Ethereum loses institutional interest for the third week in a row, with $ 1.4 million being withdrawn.

Though the biggest altcoin out there is being dropped by institutions, other altcoins like Solana, Cardano and BNB are still a popular choice with a total of $15.2 million in funds flow. In total, altcoins make around $ 15 million in the cryptocurrency market, which is almost non-existent value compared to Bitcoin’s $ 1.47 billion.