In a space as competitive and as nascent as the crypto-verse, hopes of top coins flippening one another aren’t uncommon. However, the Ethereum reversing Bitcoin narrative seems as old as time, at least in crypto terms. . In fact, the narrative gathered more steam after Ethereum’s London hard fork. Lately, however, a new thesis has been floating around the stunning tale.

So, what’s the thesis?

Decentralized finance (DeFi), Web3, Decentralized Apps (Dapps), and NFTs are all booming markets and represent a potentially huge market. Now, it can be assumed that such a huge market would eventually become larger than the market for a valuable aggregate asset like Bitcoin. Additionally, since all these developments are happening on Ethereum, it can be expected that at some point, the market cap of Ethereum is bound to flip Bitcoin.

Ethereum has a larger developer community than most of its competition, and since it also has the first-mover advantage, it appears to be the safest bet for the DApps platform category. However, with Ethereum killers emerging and taking a fair share of market value from the top altcoin, there is considerable skepticism that ETH will continue to rule the aforementioned categories.

For this thesis to be really true, the certainty would have to be that Web3, DeFi, Dapps and NFT are all found only on Ethereum, with ETH dominant. However, it would seem that the said thesis might be based on some miscalculations.

What are the misconceptions?

For starters, up to Ethereum successfully switches to their proof of stake model, execution risks remain high. Issues such as failed transactions and front-running, which are still costing users millions of dollars every day, are not subtle.

In fact, just recently an Ethereum user paid $ 430,000 in transaction fees for a failed payment. Additionally, while DeFi is destined for meteoric growth, it comes with inherent risks that could plague ETH’s network too.

In addition, ETH faces strong competition from the many Ethereum killers in the market, as well as other altcoins. Over the last month alone, Polygon flipped ETH’s active addresses and more recently, Litecoin flipped Ethereum in the same metric.

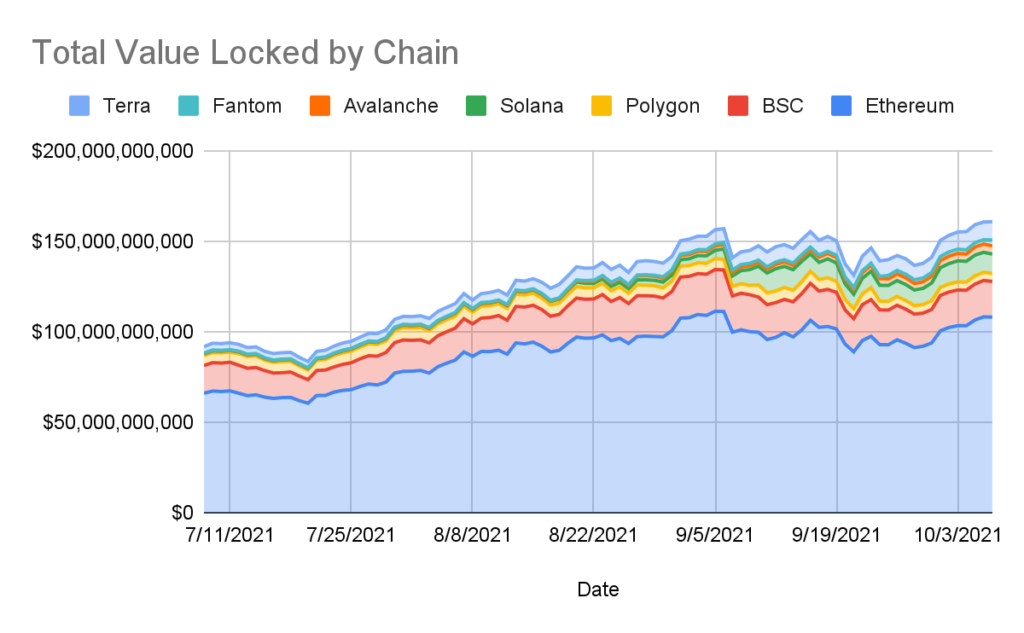

Even though Ethereum’s total locked-in value in DeFi is back around its ATH zone, up over 15% to $ 110 billion, competitors like Solana, Avalanche and Polygon have gained decent market share.

More to it than what meets the eye?

Recently, an Ecoinometrics newsletter addressed ETH flipping BTC and presented another hypothesis assuming BTC’s market size would end up in a similar ballpark as that of physical gold. In that case, there will be a bunch of scenarios that could see it drift away from its long-term store of value status.

One such scenario was that in the long term, Bitcoin could be used as a collateral asset powering the global financial system.

The fact that BTC does not face any counterparty risk, that its supply is limited and that everything is auditable, makes it an asset perfectly suited to be used as collateral. In that case, its potential market expands considerably while Ethereum could still be catching up. Thus, this hypothesis would invalidate the ETH BTC reversal hypothesis. However, this is not all.

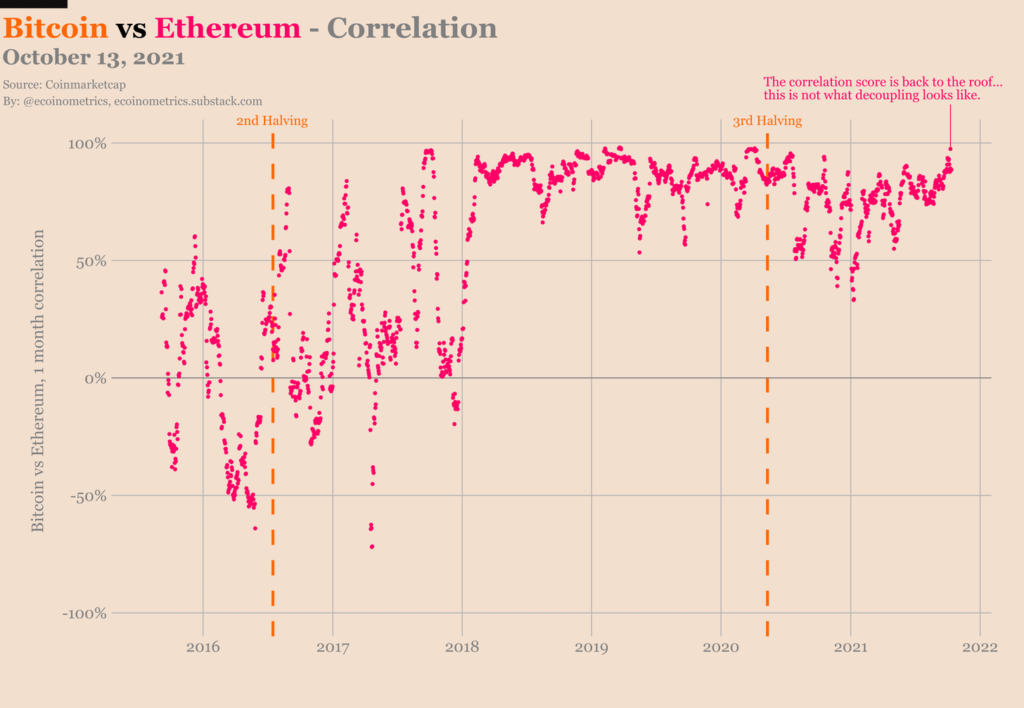

Regardless of the future, the ETH decoupling hasn’t happened yet. In fact, the correlation between ETH and BTC is skyrocketing.

At the time of writing, the ETH-BTC correlation was 0.91, much higher than top alts like ADA with BTC correlations of just 0.06, as per data from IntoTheBlock.

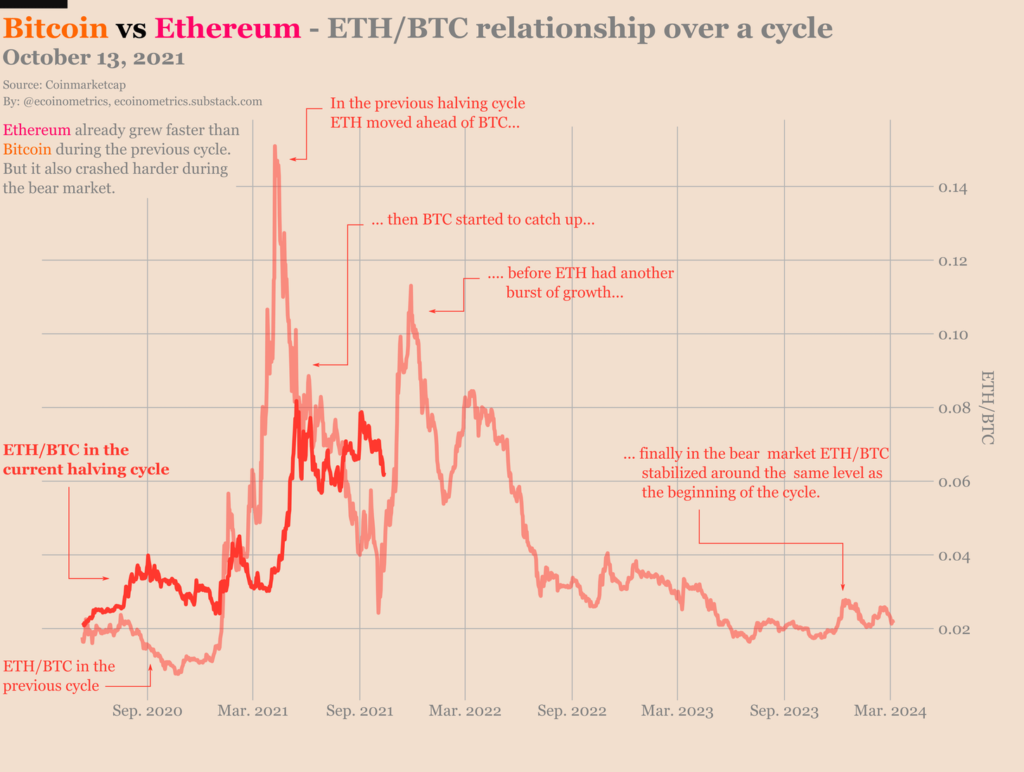

Additionally, while ETH has risen faster than BTC during this cycle, the ETH / BTC pair remains well below its all-time high of 2017.

Thus, looks like a possible flippening is far far away for ETH. That, however, in no way means that ETH won’t perform well.