This analysis takes a closer look at some of the structural measures in the Bitcoin market and compares the current cycle to that of 2017.

The following is compiled by on-chain analyst CryptoVizArt for CryptoPotato.

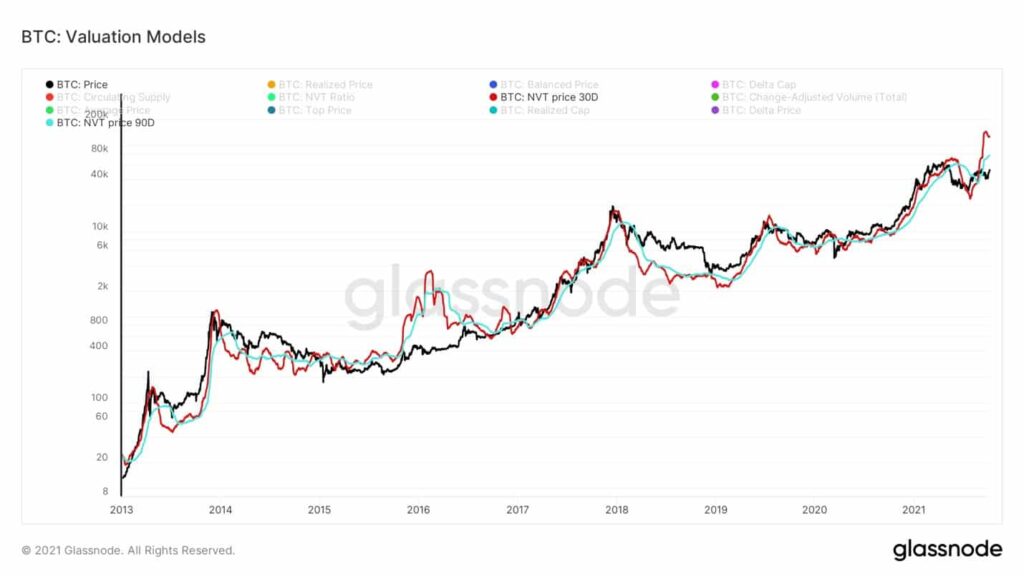

Bitcoin NVT

NVT estimates network values using its volume of investors in the chain. As crypto analyst Willy Woo initially introduced this model, NVT Price is calculated by multiplying on-chain volume by the 2-year median value of NVT-Ratio (Market cap / Total on-chain transfer volume).

In 2018, after peaking in the cycle, the 30- and 90-day MAs of the NVT price declined continuously for almost 12 months. However, since the 50% drop that took place in May 2021, these moving averages are rising to levels above their previous peaks at 64K.

This variation in NVT-based pricing results could translate into a higher level of institutional activity compared to retailers.

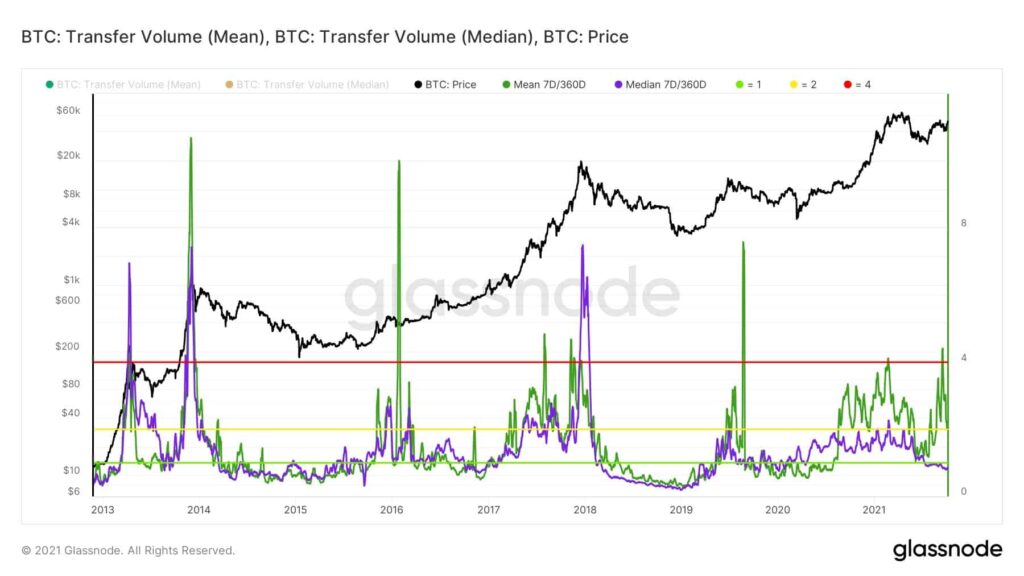

Categorical Analysis of On-Chain Activity

Historically, in all former crypto market cycles, both the 7-day MA of on-chain transfer volume Mean & Median sizes have spiked up to over 4X of their 360-day MA level and then dropped below 1X their 360-day MA.

The average and median on-chain transfer volume size are metrics for larger and smaller transactions. When the Mean value rises, it means high-volume transactions are happening more frequently. The median size, on the other hand, is an approximation of the small transactions attributed to retailers.

Surprisingly, there has not been an over 4X spike. In addition, the average value has always been correlated with the median, which means that the level of activity of large entities and small retailers increased with the rise in prices towards the new ATH up to more than 4 times their MA of. 360 days.

Amazingly, there has been a significant divergence between the Median value and Mean value. This divergence also highlights the imprint of larger entities in this ecosystem with different conviction and vision.

The Fund Flow Ratio of Bitcoin: Are Insitionals Here?

Following the discussed apparent footprint of large entities above, another valuable on-chain metric, called Fund Flow Ratio, can be studied to evaluate this assumption.

Institutional players mostly transfer their assets off stock exchanges (on-chain). Therefore, we can trace the category’s weight by measuring the Fund Flow Ratio (on-chain transfer volume that is not sent to/withdrawn from exchanges divided by total on-chain transfer volume). Studying the historical trend of this ratio shows that it subsequently declined after reaching the ATH and entered the bear market.

This ratio, however, has been increasing since Jan 2021, despite the 50% market correction in May. Almost 96% of on-chain transactions are not attributed to withdrawals / deposits from exchanges. The simple conclusion can be that institutional involvement in crypto markets is increasing.