Bank of America released their latest crypto report this week, as Bitcoin returns north of $50K. BofA strategists Alkesh Shah and Andrew Moss explained the crypto market as “too large to ignore” which “there could be more opportunity than skeptics expect.”

Let’s take a bird’s eye view on key findings from the 140+ page report.

Crypto, Institutionalized

As BTC hangs tough above $50K, both BofA and our team’s internal perspective on Bitcoin inflows reflect strong institutional interest.

Additionally, beyond just conventional banks, Bank of America likewise mentions the capacity for additional combination of blockchain innovation in life. “In the near future, you may use blockchain technology to unlock your phone; buy a stock, house or fraction of a Ferrari; receive a dividend; borrow, loan or save money; or even pay for gas or pizza,” the report states. Of course, several tasks are currently dealing with tools for a few of these precise usage cases, and a lot more.

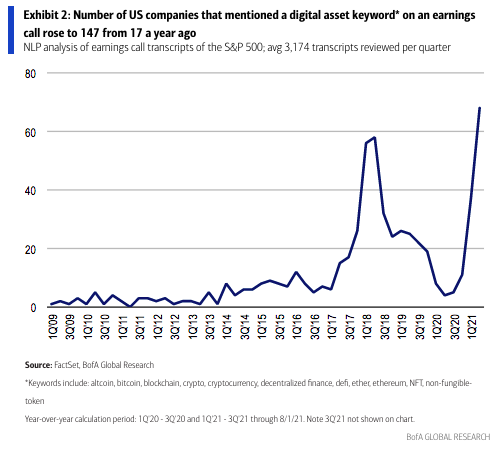

Outside of existing economies ripe for reinvigoration, the report also calls out projects and firms that are becoming inherently native to the digital asset ecosystem. There has actually been adequate development throughout both of these classifications, exhibited by the listed below chart revealing points out of digital possession language on profits calls:

If there is one thing that is abundantly clear, it’s that digital assets are on major corporate radars, and as BofA states – “corporations aren’t risking being left behind.” These profits calls consisted of business in infotech and finance, however likewise consisted of customer staples, realty, healthcare, and more.

All The Rest: DApps, NFTs, And The Regulatory Battles

It’s hard to justify bucketing the immense growth of DeFi, Dapps, and NFTs all in one place while still giving the respective categories their fair shake. Nonetheless, that’s what we’ll do here to offer a quick wrap-up on Bank of America’s ideas on whatever that isn’t a fungible token or simple blockchain job.

The report soberingly acknowledges the emergence of DeFi, despite it being seen as a continual threat to traditional financial firms like Bank of America themselves. BofA explained Dapps as having the prospective to bring monetary services to almost 2B unbanked people around the world. What many crypto advocates and loyalists have been thinking and working towards is now becoming widely acknowledged by some of the biggest traditional institutions in the game.

When it concerns NFTs, the brief stroke is that the belief shows digital properties in basic: Bank of America is bullish. The firm describes NFTs as “changing the way creators connect with fans and receive compensation.” Indeed, as BofA acknowledges, NFTs have enormous capacity in showing ownership with no sort of intermediary charge – which this is considerable need for this throughout a variety of verticals.

Finally, regulatory uncertainty was cited in the report as the largest near-term risk in the firm’s view, and understandably so. That regulative danger might be worsened with stablecoins, nevertheless the report kept in mind that regardless of less liquid reserves (which might cause increased regulative analysis), stablecoins are “a waiting zone between fiat currencies and digital currencies, which could further accelerate adoption of the latter.” The report adds that central bank digital currencies (CBDCs) are a “when, not if” situation.

Close The Curtain

In summary, we’re viewing all of it unfold in genuine time. The report specifies that over 20M U.S. grownups own digital properties (approximately 14%) while an extra 19M+ intend on purchasing digital properties at some point this year. However, rising interests are just limited to individuals, but also live within corporations.

Furthermore, development in ownership, interest, and so on. doesn’t stop or begin with Bitcoin. Bitcoin has amassed one of the largest market values on the planet, and in this case is the rising tide that is lifting altcoin boats. The BofA report dives into Twitter reference analysis, which revealed that Bitcoin points out reduced year-to-date (since August) while numerous altcoin points out increased. In the meantime, Bitcoin volatility has decreased relative to the early years, as increased adoption leads to more “diamond hands.”

Additionally, CBDCs are on the horizon. Bank of America estimates that nations including approximately 90% of worldwide GDP are apparently checking out CBDCs. Meanwhile, engagement in NFTs and DeFi products are increasingly rapidly as well.

While acknowledging regulative difficulties that the marketplace will need to get rid of, the BofA report doesn’t avoid hard subjects either. Illicit activity with crypto has been a staple for bears, however BofA notes that digital assets associated with illegal activities have been cut in half compared to 2019. In all, BofA is undoubtedly positive looking forward. As more traditional finance operations come to terms with crypto’s role across a variety of industries, adoption is only set to increase. Fasten up and hold on to your seats.