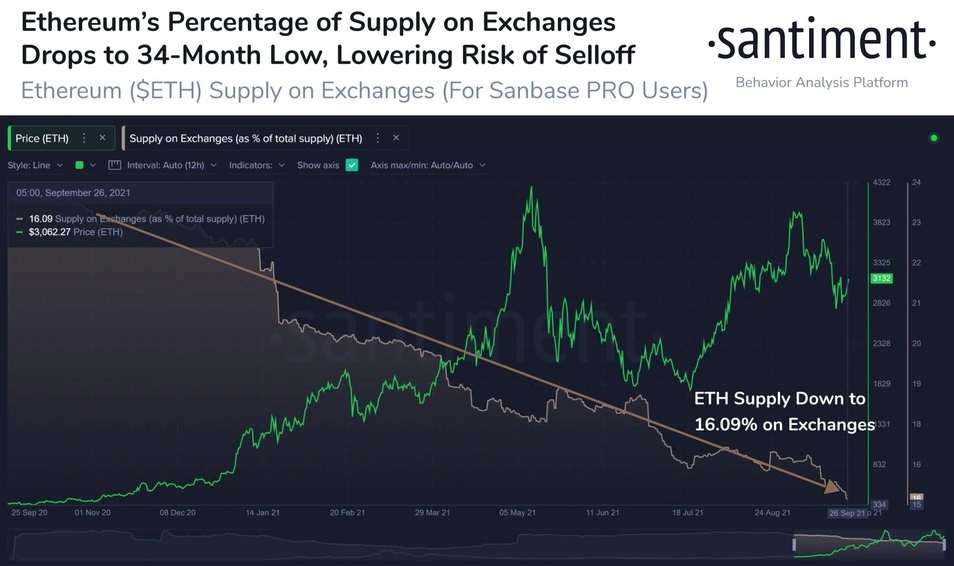

The overall demand for ETH continues to increase with new on-chain data suggesting that the total supply held on exchanges has declined by approximately one-third in the past year alone. As such, less than 20% of all existing ETH is currently found on trading platforms.

Investors withdraw ETH tokens

It’s safe to say that the Ethereum blockchain is arguably the most utilized network in the cryptocurrency space. After all, it’s home to many projects spanning two of last year’s hottest trends: non-fungible tokens and decentralized finance.

Recognizing the protocol’s potential, investors started praising its native cryptocurrency a while back and begun allocating substantial funds to it. Some of the more notable names, even outside of the community who have openly admitted to owning parts of the second largest cryptocurrency, include Mark Cuban and Robert Kiyosaki.

On-chain data from the analytics company Santiment suggests that most Ethereum investors seem bullish as the number of ETH tokens sitting on exchanges has gone down dramatically in the past year.

As of September 26, 2020, 24.1% of the overall ETH supply was on trading platforms. Fast-forward a year later, and the percentage has decreased by roughly one-third to 16.1%. Therefore, the analytics company concluded that “this is a good sign for hodler patients.”

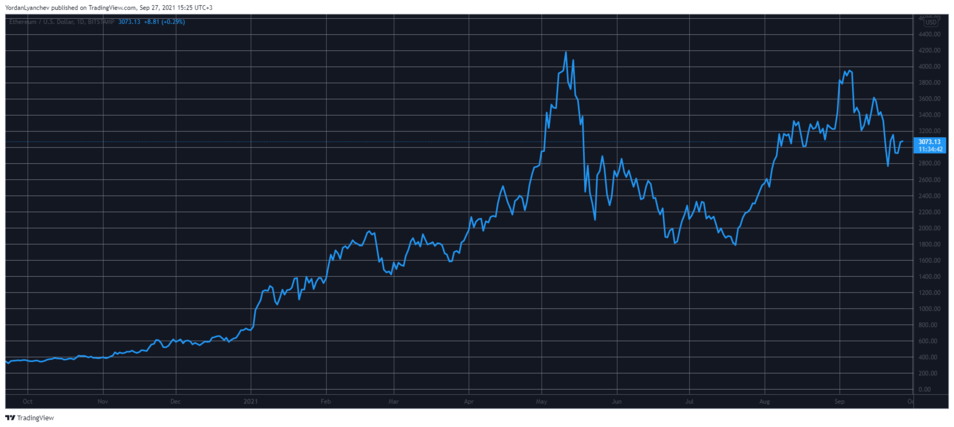

ETH’s Price Surge in a Year

The decreasing supply of ETH held on exchanges essentially means that investors are not in a rush to sell their coins, which could be regarded as a bullish sign. Watching what happened with its value in USD during the same period in which the supply on the exchanges fell is quite impressive in itself.

On September 26th last year, ETH traded around $350. It experienced a full bull run over the following months and more than doubled in value by the end of 2020.

2021 started on a high note as the second-largest crypto kept doubling in price, it broke its 2018 ATH and reached unseen highs. It all peaked in mid-May when he set his current record of $ 4,400.

Despite the subsequent retracement and volatility, ETH still stands today – a year later – at around $3,100. This means that during the same period that investors were removing ETH from the stock exchanges, the price of the asset soared by almost 800%.