The upcoming launch of Ethereum Improvement Protocol (EIP)-3554 is intended to turn the proof-of-work mining method obsolete. There are plans to drop a difficulty bomb in order to achieve this goal.

This will make ETH mining almost impossible and force miners to update their systems. However, the real question is: should people really care? Considering the after-effects of the EIP-1559 launch, the answer to that might come as a surprise.

Debate over burning Ethereum gas fees

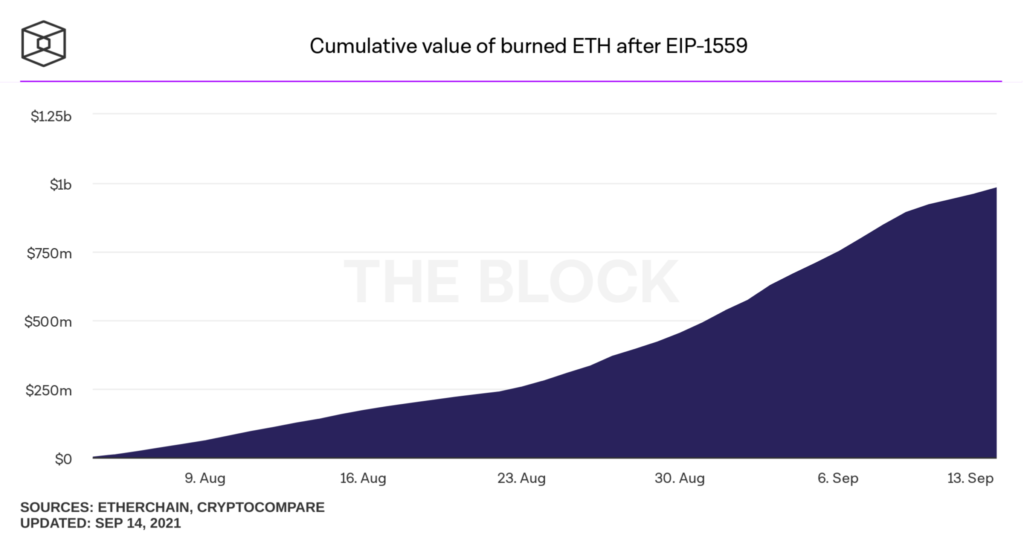

In the past 24 hours, the total value of ETH burned has approached $ 1 billion. In fact, at press time, it was just short of $20 million, a level it will definitely achieve by the end of the day since daily burn averages around $24 million.

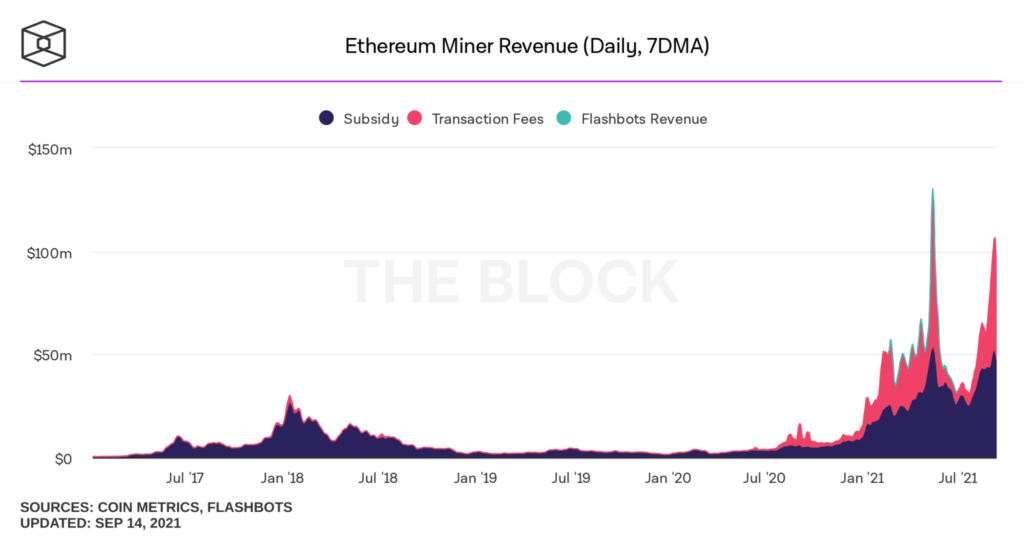

Now it is clear that the concern around EIP-1559 affecting minors is no longer a topic of discussion. Since the restructuring of fees on 4 August, miner revenues have grown exponentially, with the same hiking by 134%.

Despite the consumption of fees, however, transactions on the network alone were successful in pushing miner earnings to a record high of $ 106.51 million on September 10. The figures were only $24 million short of its ATH in May.

Surprisingly, at the time of publication, transaction fees accounted for almost 80% of total miners’ income.

How so?

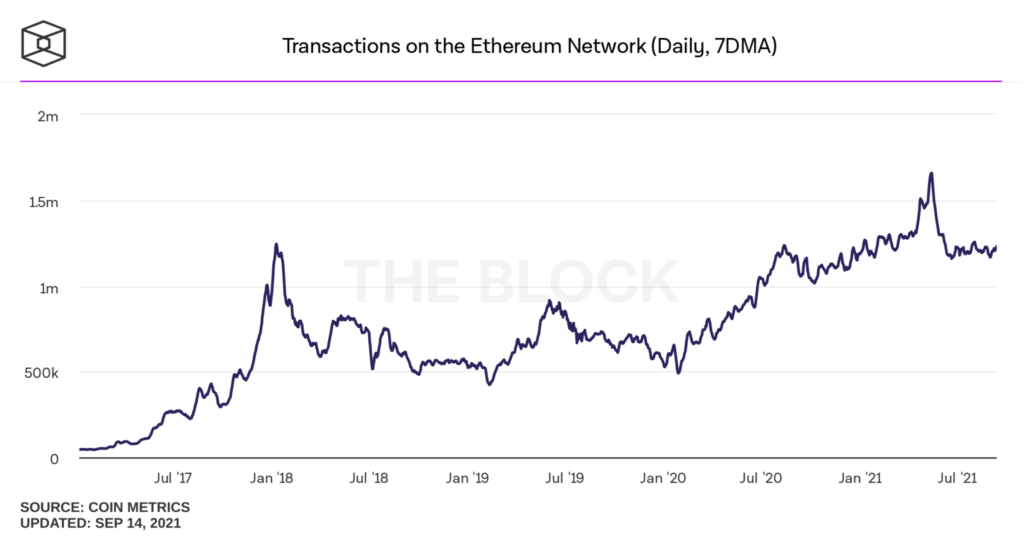

This has been the case primarily due to consistent transactions on the chain, which have been steady above the 1.1 million mark for over 3 months now. They remained steadfast through both the rally and the crash.

In fact, yesterday, owing to increased transactions and an increasing number of miners, the hash rate reached an all-time high of 715k GH/s. Similar consistency in the number of transactions can also be observed in daily gas consumption.

Gas used has been above 100 billion Gwei since August, peaking at 101.115 billion on 5 September.